So, the next (final?) round of stimulus was signed into law by President Biden.

Let’s dive in.

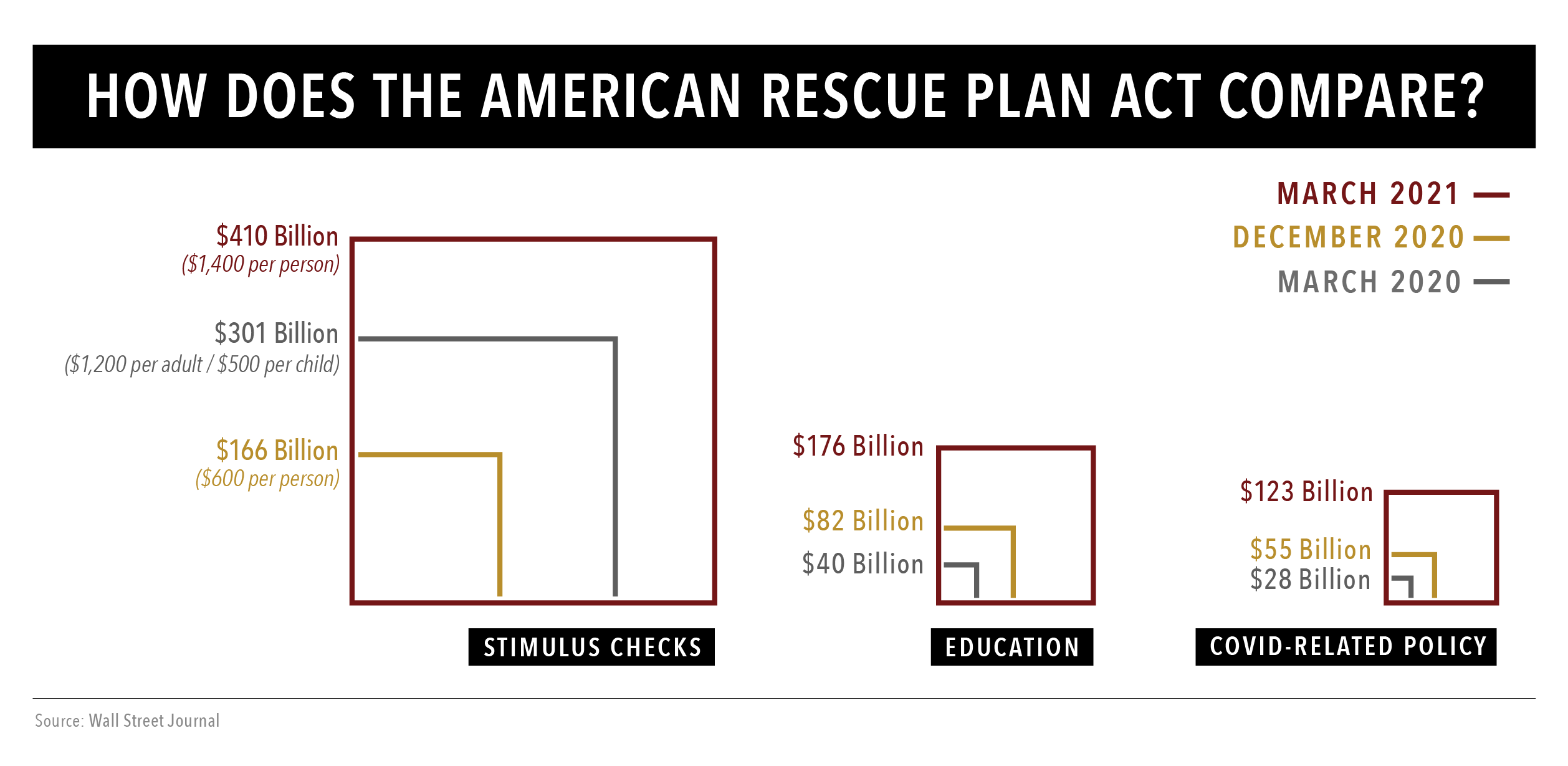

The $1.9 trillion bill called the American Rescue Plan Act of 2021 includes stimulus checks, child tax credits, jobless help, vaccine-distribution money, healthcare subsidies, and aid for struggling restaurants. What’s not inside? A higher minimum wage.

Here’s a quick visual of how it compares to prior rounds of stimulus.

Here are some immediate takeaways:

More stimulus checks are coming: $1,400 checks could be hitting bank accounts and mailboxes this month, going out to adults, children, and adult dependents such as college students and elders. These adult dependents did not qualify for previous payments.

Who gets paid? Individual filers who earn as much as $75,000 (or joint filers making $150,000), plus their household members, qualify for the full $1,400 per person.

Not sure if you qualify? The Washington Post put out a handy calculator to help you figure it out. (Accuracy not assured, etc., etc.)

If you’ve filed your 2020 taxes, your check would be based on that income. If not, it would be based on your 2019 tax filing. If you’re waiting for a missed payment, individual tax returns have an extra line called “recovery rebate credit” to claim your stimulus payment.

Enhanced unemployment benefits are extended through Sept. 6: Folks claiming jobless benefits will receive $300/week on top of what they already get from their state through the fall.

Some unemployment income is now tax-free: Individuals who earned less than $150,000 in 2020 can shield up to $10,200 in unemployment benefits from taxes. For married couples filing jointly who both received unemployment, the tax-free amount goes up to $20,400, but the $150,000 income cap still applies. If you earn over $150,000, it currently appears that all of the unemployment benefits become taxable with no phaseout.

If this applies to you or someone you love, my advice is to wait to file or update your tax return until the IRS issues guidance on what to do.

The child tax credit is larger: The bill increases the child tax credit for one year to $3,600 for kids under 6, and $3,000 for kids between 6 and 17 (the current credit is a flat $2,000 per child under 17). 50% of the credit would be available as advance monthly payments that the IRS will start sending to families in July 2021.

Not all families will qualify. Phaseouts begin at $75,000 for single filers, $112,500 for heads of households, and $150,000 for joint filers. However, families who earn less than $200,000 ($400,000 for joint filers) could still claim the regular $2,000 credit.

Health insurance costs could drop on health exchanges/marketplaces: The bill removes the income cap on insurance premium tax credits for folks who purchase insurance on the federal health exchange or state marketplace (for two years). That means the amount you would pay for health insurance would be limited to 8.5% of your income as calculated by the exchange.

Final thoughts

A lot of rules have changed in the last year, throwing an already complex tax season into a bit of confusion.

Could there be more stimulus passed this year? It seems very unlikely at this time.

My fear is that all the simulus has delayed the real economic cost of the virus.

Let’s hope my fear is unfounded!

Wyatt Swartz

Hi all,

Did you hear GameStop went viral?

Here’s a quick guide to the market frenzy you’re seeing in the headlines.

Long email ahead. (Buckle up, it’s a little complicated.)

What is GameStop and why does everyone care?

GameStop is a brick-and-mortar video game chain that hit hard times in the pandemic. Like many distressed companies, it was targeted by short sellers betting that the stock’s price would go down.

Basically, short sellers do the opposite of most investors. They try to make money when a stock’s price falls. They borrow shares from their brokerage for a fee, immediately sell them, and plan to buy them back later at a lower price when the price falls. Shorting is a strategy used by certain types of hedge funds.

What’s a short squeeze?

Shorting stocks is risky since any positive news or interest in a company can drive the stock’s price up. When short sellers bet wrong and a stock’s price rises, they can be forced to buy shares at higher prices to cover their losses (or pony up more collateral).

A squeeze happens when short sellers scramble to buy shares to cover their positions when the stock price is rising. The more investors who buy and hold those shares, the harder it is for short sellers to find shares to buy (exposing them to potentially huge losses).

With me so far?

Where does Reddit come in?

After it became clear that short sellers were betting on GameStop’s demise, the videogame retailer became the focus of amateur traders on the popular WallStreetBets forum on Reddit, a popular community of chatrooms and forums.

By banding together and coordinating buying activity, these small-time traders boosted the stock’s price far above what the company’s financial fundamentals support, putting pressure on the hedge funds betting the other way.

The stock went viral.

Why?

Social media chatter + free trading apps like Robinhood + bull market + new investors with time on their hands = FRENZY

Is it illegal? That’s a stretch. These armchair traders are egging each other into speculative bets, but I don’t think it rises to the level of illegal market manipulation. However, regulators might feel differently.

Is it bad for markets? The battle between gleeful amateurs pushing prices up and hedge funds scrambling to force prices down has led to some of the highest volume trading days on record and cost short sellers billions.

Is this David vs. Goliath?

I don’t think the GameStop bubble is just about greed or boredom or euphoria. I see a powerful narrative at play.

I think a lot of these small traders are angry at the perception that All-Powerful Wall Street is pulling strings and using their connections to hurt mom-and-pop investors. They see this as an opportunity to stick it to the big-money pros by using their own strategies against them.

It’s new school vs. old school. Rebels vs. the Empire. Bueller vs. Principal Rooney. Reddit vs. CNBC.

So, should I be investing in GameStop?

No. GameStop’s stock is massively inflated and trading has been halted multiple times because of its meteoric rise. At this point, it looks like folks are piling in just to say they were there.

When the bubble bursts, it’ll be a rush to sell and many GameStop holders will end up losing most of their investment.

(It might already be happening by the time you read this.)

We’ve seen frenzies like this many times before. Tulip mania in the 1630s, the Nifty Fifty in the 1970s, the dot-coms in the 1990s, Bitcoin’s multiple bubbles over the last decade, etc. We’ll see more in the future.

Why are people angry at Robinhood?

Amidst the buying frenzy, Robinhood and other popular brokerage platforms suddenly restricted trading on several red-hot stocks, including GameStop.

Protests erupted from investors, many market pros (not the short sellers, obviously), lawmakers and more.

Did Robinhood halt trading to appease big investors at the expense of small investors? Did they do it to protect markets from manipulation and liquidity problems?

Personally, I think Robinhood could not handle the volume of trade orders coming in and stopped trading because they could not ensure the integrity of the orders.

I dislike the idea that a broker can just shut down trading in a security. I think it opens the door to situations where platforms prioritize one investor over another and that’s a massive conflict of interest.

I’m frustrated on behalf of everyone else affected by brokerage outages and difficulty trading.

But frankly, it’s pretty wild that a bunch of regular folks with small trading accounts can bring massive institutional investors to their knees.

What are the implications of this frenzy?

There’s no predicting the future, obviously, but I think a few things are likely. Most bubbles end naturally when the euphoria turns to panic, folks start selling, and the price crashes.

However, it’s also possible that regulators will step in if they think there’s risk to markets (or they see too many investors getting hurt).

Hopefully, regulators do not interfere. They would inevitably do more harm than good. Investors be they small or big, should NOT expect regulators to bail them out simply because they made stupid decisions.

All investors should assume the risks and reap the rewards of their own choices.

I think this ride’s going to end in tears for many folks caught up in it. But I’m not sure who will be crying hardest.

I think markets will see some wild swings and pull back from their frothy highs, at some point this year.

But, I think we’ll be left with some pressing questions once the dust settles.

Will social media traders continue to drive big market moves?

Do platforms have the right to arbitrarily decide customers can’t trade?

Are coordinated moves by small investors a danger to markets?

Should regulators be watching hedge funds more closely?

This is an evolving situation so I’m keeping a close eye on markets to see what might happen next.

Questions? Thoughts? Please hit “reply” and let me know.

On a lighter note, could we have a more interesting matchup in the Superbowl?

Have a wonderul week!!

No more meme stonks, please.

Sincerely,

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

Over the next 12 – 14 months stock markets will act as weighing machines between the positive and negative forces that exist in the world. Ultimately, the direction and magnitude of movement for stock markets will be determined by the balancing of these positive and negative forces.

What we think:

Widespread vaccination and the subsequent “reopening” of economies should allow economic growth to surge in the second half of 2021.

The combination of positive sentiment and high valuations in US stocks will hold back returns, because much of the good news is already baked into current prices.

More predictable trade policy from the US will lead to stronger international growth and a weakening of the US dollar in relative terms.

With democrats holding a small majority control of Congress it is likely we see more stimulative fiscal policy. This furthers the case for a weakening dollar and international stocks.

It is likely that we see a steepening of the yield curve over the next year. The Fed seems poised to maintain very low short-term rates until “maximum employment” is reached. A widening spread between short-term & long-term rates would be a positive for financial stocks.

Earnings should rebound in 2021. However, US stocks will likely be constrained by valuations that are historically high. This bodes well for international and emerging market stocks which have much lower valuations relative to US stocks.

What does it all mean:

While I believe stocks are in the early stage of the next great bull market cycle. High valuations and overly positive sentiment create an environment perfect for market corrections and a temporarily sideways market. Earnings need to catch up with prices.

Investors should use corrections as an opportunity to invest idle cash, and/or rebalance their portfolio heavier to stocks.

Investors should overweight to international & emerging market stocks relative US, because of attractive relative valuations, and a weakening dollar. Investors should overweight cyclical, and small cap stocks which will see bigger bumps in the early part of the recovery.