This week it was revealed that one of the reasons the Fed did not begin the forever coming rate hike was concerns over volatility in the market. At one of my previous firms we use to say “volatility is normal, and volatile.” That statement is still true today.

Volatility is always going to be present in equity markets. When that isn’t the case, we will all be looking somewhere else to get return on investment. Hopefully and likely, it will never come to that. Anything is possible, but that scenario is certainly not probable.

It is true that the current bull market has experienced unusually low volatility, considering the market hasn’t experienced a correction since 2011. The market typically whether it’s a bull or bear market has a correction every 12 months. I believe we are in the midst of a correction currently, but only time will time tell. I could always be wrong.

From 1928-2010 the S&P 500 averaged 61.9 days per year with a greater than a 1% swing. The median number of days over that period was 51.5 days.

We as investors should not want low volatility to continue, and we should not expect it to continue. We as investors need to embrace volatility and take solace in knowing that others are panicking and destroying their portfolios.

According to a chart by JP Morgan in their 4Q Guide to markets, the average investor returned an annualized 2.5% from 1994-2014. That is absolutely dreadful, over a period that saw the S&P annualized 9.9%.

Let’s not be in that 2.5% group, we are better than that.

– Wyatt Swartz

– 10/9/2015

When you are looking at the markets, always, always remember that you could be wrong. Never get arrogant, and always try to think about what would happen to your portfolio and your life if everything you think will happen goes in the other direction. Thinking about things that way is how you determine your asset allocation. That is a another discussion for another time.

The issue at hand is that with the strong market performance today Friday 10/2/15, relatively flat performance yesterday, and the strong performance on Wednesday, the V formation of the market correction might have just formed.

On August 21st after the worst week for stocks since 2011 I said that it looked like we were moving into a market correction and that the right course of action for investors was to hold on for the bumpy ride.

At the time I felt that the economic data was boring, but positive. The data that has come out over the last month has been overwhelmingly positive as well, all be it nothing to throw a party over.

Market corrections are a normal and natural occurrence in the midst of a bull market. They are sharp, sudden, and come about for reasons that don’t make any sense… like Ebola or no reason at all. No one to my knowledge has ever had a consistent track record of sidestepping corrections.

Overwhelmingly panicked investors see the correction, fear that it’s a bear, and whipsaw their own portfolios by selling at the absolute worst time.

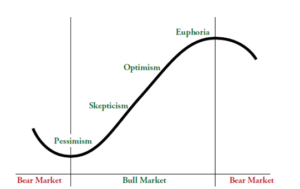

Bull markets tend to run until they are knocked off by some unforeseen thing or they run out of steam. In the second scenario, the market runs until investor sentiment becomes overly enthusiastic, even euphoric. The corporate data and the overall economic data doesn’t warrant such a drastic run and their is a rollover effect.

I do not think we are there yet, and if we are currently in a market correction, it should only help the bull market continue to run in the long-term.

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” Sir John Templeton

– Wyatt Swartz

– 10/2/2015

As the week comes to a close it looks like stocks will have their worst week since 2011. Global stocks have dipped into the negative territory for the year and people might be panic selling. I see that as a very bad move for the typical long-term investor. Is this the beginning of the next prolonged bear market drop of more than 20%? It certainly could be, but I doubt it. The sudden (seemingly from nowhere) sharp drop of the market this week smells like a classic correction. Having a correction within the course of a year is typical. Trying to time corrections is impossible and will only lead to underperformance.

Remember that volatility is good for long-term growth, it is one of the reasons we get superior long-term performance from stocks vs. say bonds.

One quick positive indicator for this bull market to continue is that I currently see 7 articles on www.realclearmarkets.com with headlines pointing to the eminent demise of the market. That is an unscientific indicator that sentiment is not at “danger zone” euphoric levels.

I always like a good correction, it helps weed out the weaker investors.

– Wyatt Swartz

– 8/21/2015

- « Previous

- 1

- …

- 40

- 41

- 42