There’s REAL & reported inflation.

2021 = Highest Inflation

I would like to quickly follow up from my previous message regarding inflation.

The numbers for December inflation were released, and now we have numbers for all of 2021. Inflation judged by the CPI Index rose 7% in 2021, the largest 12-month increase since the period ending June 1982.

As previously mentioned, the method for calculating CPI today is different than it was in 1982. Using the previous method of calculation, 2021 would have been the highest CPI in history.

Today inflation in housing costs is largely measured in the CPI using something called “owners’ equivalent rent.” I will spare you the wonky details of what it is, but say it drastically underreports housing cost increases. Owners’ equivalent rent was reported as increasing 3.8% in 2021. In 1982 the BLS was using “home prices” for that component of the CPI. Home prices rose in 2021 by more than 16%.

If you replace “owners’ equivalent rent” with “home prices” you get an inflation rate of 10% for the 2021.

I believe high inflation will force a rotation of leadership within capital markets.

As I write this…

US large cap stocks are -0.58% on the day.

US large cap VALUE stocks are +0.23% on the day.

International DM large cap stocks are -0.29% on the day.

International DM large cap VALUE is +0.60% on the day.

The shift in capital markets will not be as clean each trading day as it appears today, however I do expect it to continue to play out for the “foreseeable” future.

Sincerely,

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

Inflation was the biggest economic topic of 2021, and I believe this will continue through 2022.

Inflation might not be as temporary as the Federal Reserve would have liked us to believe. They’ve prefered the term“transitory” to “temporary”, I suppose to sound more sophisticated.

Prices are up everywhere, and folks are understandably upset at paying more at the grocery store, gas station, and most everything else.

Many analysts hoped that data blips, supply chain clogs, and other pandemic-related disruptions were creating a temporary spike in inflation that would quickly resolve.1 This hope was shareed by the Fed which pushed the “transitory” narrative most of 2021.

They were wrong, and 2021 saw a constant stream of reports detailing surging inflation numbers. The Fed has more recently capitulated and admitted that inflation might be more sticky than advertised.

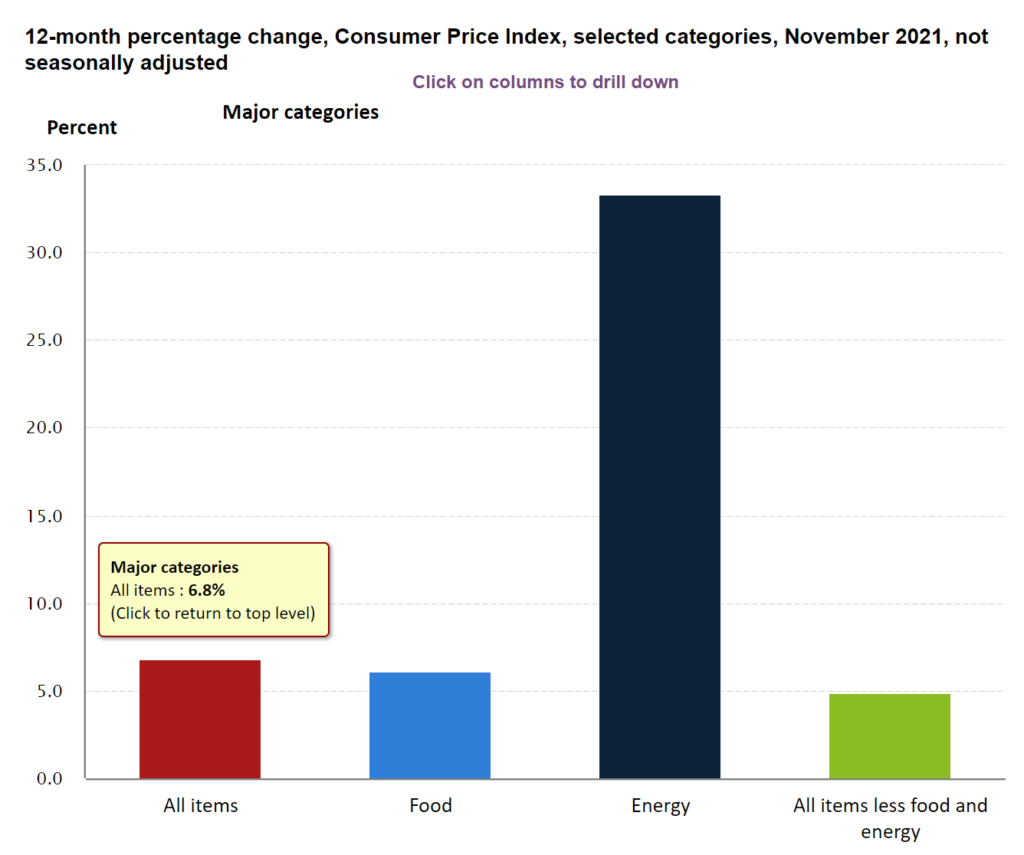

Prices have increased 6.8% over the last 12 months (through November) — the biggest spike in 31 years. And you can see in the chart that some categories measured by the Consumer Price Index (CPI) have soared by much more.2

The reality of inflation is much worse than the official numbers show. There have been adjustments to how CPI inflation is calculated, and an apples-to-apples comparison inflation is at levels not seen since the early 1980s.2 I have seen multiple estimates that put inflation above 12% when using the older methodology.

What is inflation?

Inflation is a decline in purchasing power of a given currency. Said another way, it is when prices go up, and it costs more money to buy the same good or service. The term has changed over the last century. In the 1800s inflation meant an increase in the money supply, and it was simply understood that increasing money supply leads to higher prices. It is possible for prices of some goods/services to increase without an increase in money supply if those goods or servies become more valuable or scarce.

What is deflation? Is deflation negative for economies?

Deflation is the opposite of inflation. It is when prices generally fall, and purchasing power increases. If the money supply were to remain constant, then a constant deflationary environment (vs. inflationary) would occur within free-enterprise economies. This occurs because production increases over time, and the increase in production leads to decreased prices.

Deflation is not negative. This is a very commonly held myth. One of the most extensive deflationary periods in US history, was 1869-1879. This period saw prices generally fall by 3.8% per year. Yet, it coincided with 3% per year increase in national product growth, 6.8% per year growth in real national product, and a phenomenal 4.5% per year in real product per capita. It was one of the most expansive economic periods in US history, all occuring during deflation.7

Devaluation vs. Inflation: What’s the difference?

When the quantity/supply of money (in our case Dollars) increases, the value decreases. Money devaluation is often accompanied by inflation, but this is not an absolute, and that is why today we differientiate between devaluation and inflation.

Prices for some goods and services can remain the same, and even decrease while money is being devalued. This occurs when productivity outpaces the increase in money supply. In this scenario, if money was not devalued, prices would have fall.

Gresham’s Law: Legally overvalued money tends to drive legally undervalued currency out of circulation.

Can the Dollar Strenghten with inflation?

Yes, if foreign currencies are devalued/inflated at a higher magnitude relative to US Dollars, then the Dollar will strengthen relative to those other curriences. For most of the 1900s, European countries inflated their currencies, in some cases to the point of collapse. The US Government & Fed spent most of the 1900s engaging in inflationary practices too, but the magnitude was not nearly as severe as European counterparts. This eventually led to the Dollar taking the position of world reserve status.

Additionally, if one currency is simply perceived to be more valuable it will strengthen relative to other currencies without changes to the existing quantity of either currency. The classic example would be that of a currency in a country where the government in power is seen as unstable.

2021 saw massive inflation in the US, and a strengthening dollar.

How does the Federal Reserve System “the Fed” fit into this?

In theory, the Fed is an independent (of the Gov) central bank whose primary function is to ensure a sound money. The Fed is supposed to act as a check on the Government, on behalf of American citizens.

The Fed is supposed to increase money supply during periods of economic expansion, preventing deflation, and stabilizing prices. Conversely, the Fed is supposed to decrease money supply during econonmic contraction, preventing inflation, and stablilizing prices.

Since its creation, the Fed has rarely acted as a check on Government. It has redifined and expanded its mandate multiple times, and has mostly acted as the chief enabler of the Government budget deficits.

Despite economic contraction during the pandemic, the Fed increased money supply. Thereby creating a massive perfect storm of less production (supply curve) and more money (demand curve). Freshman microeconomic students can tell you that when supply curve decreases and demand curve increases, prices rise.

The circumstances of the last two years were unique and may have called for unique policies by the Gov. and the Fed. That is a political question, that is irrelevant to our discussion.

The policies of the current and previous administrations, and the Fed policies were inherently inflationary.

Is inflation “transitory?,” temporary if you prefer?

The answer is entirely dependent on perspective. Inflation, has been nearly constant at varying magnitudes ever since the Federal Reserve System was established in the early 1900s. It will likely continue to be a constant barring major reforms to the US monetary system.

There is no reason to be optimistic about inflation looking out for the next 100-years under the current system. The Government is unlikely to ever meaningfully cut spending, or meaningful raise taxes. Therefore, the path of least resistence is to print more money, devaluing the dollar, and creating long-term inflation.

Over the shorter-term, there are reasons to believe the elevated magnitude of inflation will fade.

First, natural supply and demand forces favor a redution of inflation. In free markets, when prices rise rapidly it increases the incentive to increase production/supply, which… reduces prices. You could say that “high prices today eventually lead to lower (or at least stable) prices tomorrow. Said another way, it is hard to sustain this pace. Eventually, it runs out of steam.

Second, there were unique inflationary actions occuring in 2020 and 2021 that are unlikely to continue. Economic activity in the US and all over the world was forcibly stopped (halting or decreasing production – supply curve), while money was increased (increasing demand curve) and directly injected into cirulation. Neither of these actions are likely to occur at the same magnitude in 2022 as occurred in 2021 and 2022.

It is important to point out that even if we do see slower rises to inflation numbers in 2022, doesn’t mean falling prices. Erosion of purchasing power is still happening, just at a slower pace.

Specifically, 2022 what is the inflation expectation?

Through November, consumer inflation rose 6.8%. However, producer prices rose 9.6% over the same period. That gap will be passed on to consumers in 2022. The gap between producer and consumer prices indicates high inflation numbers still to come.

The Fed has reduced purchases of Treasuries (tapering), and indicated they would possibly begin raising interest rates soon. In the late 1970s into the 80s, then Fed Chair Paul Volcker aggressively raised interest rates to fight inflation. Many believe the Fed will take similar action today, but I do not see any indication this will happen. Raising interest rates would put significant fiscal/budget constraints on the Government. The Government would struggle to service the debt were interest rates to significantly rise.6

2020 was the first time in 20 years foreigners were net sellers of US Treasuries. This is another indicater of a weakening dollar and inflation.

My expecation for 2022 is continued high inflation with low interest rates.

What are the investment implications of inflation?

Inflation will likely lead to a category rotation within stocks. For the better part of a decade, growth stocks have led their value counterparts. If inflation, continues to persist I expect value to outperform relative growth. In an environment where future earnings are valued less, earnings today are valued more. Companies that make money today are more attractive than companies that will grow and eventually make money tomorrow.

If we see a weakening dollar, this will make international stocks more attractive relative US. International stocks are already at a major discount relative US. A shift to value, inflation, and a weakening dollar could create a great environment for investors in international stocks.

Fixed income investing will continue to be challenging, and investors will need to be creative. Investors with cash flow needs from their portfolios typically need to use fixed income assets to steady returns. Historically owning a diversified portfolio of US Treasuries was sufficient, but that hasn’t been the case for the last 10+ years and will not be in the foreseeable future. Investors will need to utilized securities that are correlated with residential housing, private credit markets, inflation hedged, and international bonds. All while keeping the more traditional bond holdings at low relative duration to avoid the risk of rising rates.

Rising rates? Yes, but I do not foresee a significant rise. If the Fed had any intention of meaningfully raising rates to dampen inflation they would have begun the process in 2021. It seems the Fed’s plan is to cross fingers and hope the problem resolves itself. If the Fed aggressively raised interest rates it would force the Gov. to make drastic budget cuts, raise taxes, or print more money (leading to more inflation). The Government is broke, but low interest rates allows the status quo to remain. This is why I believe we will continue to see high inflation with historically low rates.6

Inflation is negative for US citizens, and negative for economies. At high enough magnitudes inflation can lead to recessions, depressions, and even societal collapse. None of which are high probability events, currently.

In an inflationary environment stocks generally remain the superior asset classs.

Wishing you and yours a HAPPY NEW YEAR!!!

Sincerely,

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

P.S. It’s the time of year when the analysts start making predictions for 2022. What are your predictions for next year? What will be the big themes? Hit “reply” and let me know your thoughts!

1https://www.cnn.com/2021/11/13/economy/what-is-inflation-explainer/index.html

4https://www.bls.gov/news.release/cpi.nr0.htm?mod=djem_b_reviewpreview_20211110

Capitol Hill is producing more drama than Hollywood.

There’s a lot of bold talk, ultimatums, cliff-hangers, and confusing sequels.

We can only wait and see how this movie ends. Though, you could call your state representative and senators.

Let’s recap what we know with some educated speculation about what could happen next.

Congress is currently debating two action items on President Biden’s “Build Back Better” agenda: The American Jobs Plan (Physical Infrstructure, Bipartisian support in the Senate) and the American Families Plan (Reconciliation Bill, “Human Infrastructure,” expanded social welfare programs, includes individual tax increases).1

The Infrastructure Bill ($1.2 trillion) passed with bipartisan support in the Senate, and now is being held hostage in the House of Representatives as leverage to force more centrist Senate democrats to pass the Reconciliation Bill ($3.5 trillion, American Families Plan).

The American Jobs Plan ($1.2 trillion) – “Infrastructure Bill / Bi-partisan Bill”

- $110 billion for roads, bridges, and other major projects

- $11 billion in transportation safety programs

- $39 billion in transit modernization adn improved accessibility

- $66 billion in rail

- $7.5 billion to build a national network of electric vehicle chargers

- $73 billion in power infrastructure adn clean energy transmission

- $65 billion for broadband development

- Increases corporate tax rate from 21% to 28% 2

The Reconciliation Bill is significantly more mysterious apart from the spending and proposed tax increases.

The American Families Plan ($3.5 trillion) – “Reconciliation Bill, Human Infrastructure”

- Expands Medicare.

- Taxpayer funded community college and prekindergarten.

- Increases the “federal safety net.”3

Neither plan looks close to passing in its current form, so nothing is set in stone yet.

But the provisions below offer a blueprint for what could happen.

The House is negotiating a package of tax increases to partially fund the Reconciliation Bill.

If passed as-is, it would:

- Increase the top marginal income tax rate to 39.6% for individuals earning more than $400,000, joint filers above $450,000, and head of household filers above $425,000.

- Raise the top long-term capital gains rate from 20% to 25% for those same folks.

- Add a 3% tax on incomes of over $5 million.

Retirement accounts may see new restrictions.4

Roth conversions would be eliminated for individuals earning above $400,000.

Folks in that income bracket would also be prohibited from contributing to retirement accounts with an aggregate value over $10 million the prior tax year.

Another critical change that would affect all taxpayers: The bill prohibits all employee after-tax contributions to qualified plans and prohibits after-tax IRA contributions from being converted to Roth, thus potentially eliminating backdoor Roth conversions and MEGA-backdoor Roth convervisions.

Estate planning may get more complicated.4

The estate tax exemption would effectively be cut in half from $11.7 to $5 million.

The deal would also eliminate certain tax benefits of “grantor trusts” as well as limit valuation discounts on non-business assets.

Trusts with income over $100,000 would have an additional 3% surcharge tax.

Currently, these provisions would apply only to future trusts and transactions that happen after the effective date of the law.

More taxes for business owners.

There would be a 3.8% Net Investmetn Income Tax (NIIT) to S-corp distributions for taxpayers with income higher than $400,000 (individual) or $500,000 (married filing jointly).

How likely are all these measures to pass?

There is some chance that neither bill passes into law, but I see that as an unlikely scenario.

To pass the American Families Plan using budget reconciliation, President Biden needs the votes from his entire party.

Progressives are committed to passing both bills, and using the but centrists are balking at the price tag.1

To get through the Senate, it seems like both sides will meet somewhere in the middle.

A lower final cost to the bill would require less revenue to cover and might allow some of the tax increases to be eliminated.

Since the IRS has been targeting Roth conversions and large IRAs, it’s possible that those measures may pass.

When could the new laws go into effect?

It seems likely that most provisions would be effective on January 1, 2022 and apply going forward (not retroactively). However, separate deadlines could be negotiated for certain provisions.

Bottom line: Laws change. We have no choice other than to adapt.

Here are the usual caveats:

We don’t know what the final bills will look like and when (or if) they will pass.

Have questions you haven’t asked me or concerns you haven’t raised? Please reach out.

If I see moves that I’d like you to make before year-end, I’ll contact you directly.

Sincerely,

Wyatt Swartz