The stock market is a function of supply and demand. Now that we have covered that we can move on…. Whoa, hold your horses there cowboy. Yes, the markets are a function of supply and demand, but in my experience very few investors understand the mechanics of the above statement or the very powerful implications of it.

First let’s talk about the mechanics of supply and demand in the markets. In the short-term stock supply is relatively fixed. Initial public offerings (IPOs) and new stock issuances take a great deal of time and effort and are announced well in advance of the action occurring. Therefore over the next 12-18 months it is very hard for there to be big unexpected shifts in stock supply. Since supply is relatively fixed in the short-term, demand is the great driver of stock prices over short-term periods. Demand tends to change very rapidly and is very sentiment based.

Over the long-term supply curve pressures overpower demand curve pressures. Stock supply can expand or shrink boundlessly over the long-term. Supply is increased through issuances and shrinks through buybacks and cash or debt-based takeovers.

When demand for a category of stocks becomes very low and prices fall it leads to increased buybacks, mergers, and acquisitions which destroys supply and eventually will lead to higher prices. We saw this with the financial sector in 2008 & 2009, and have been witnessing it more recently within the energy sector.

Conversely when a category of stocks becomes in very high demand, usually because of recent strong performance, new supply will be added until it eventually dilutes future returns. We saw examples of this within the technology sector in the late 90s moving into the 2000 bear market and with the run up in emerging markets prior to the financial crisis.

Investment bankers make money by facilitating new stock issuances, buybacks, mergers, and acquisitions. Often times they are seen by the public as mysterious boogeymen, but their work enables the stock markets to be a very efficient function of supply and demand.

Understanding the principle of supply and demand as it relates to stock markets should help an investor to properly diversify their portfolio and avoid “chasing heat” (falling in love with a category of stocks because of recent strong performance).

– Wyatt Swartz

5/23/2017

In the classic film and book Gone with the Wind the protagonist Scarlett O’Hara is a bit of a procrastinator. She takes comfort in believing that “tomorrow” she will handle things, saying “tomorrow I’ll think of some way… after all, tomorrow is another day.”

Unfortunately too many folks take that same procrastinator attitude when it comes to managing their finances. Folks fail to realize that the time to start saving for retirement, investing, or building savings habits etc. was yesterday; but if you did not start yesterday don’t be like Scarlett and put it off till tomorrow. Start today.

One barrier I see time and again is this myth that to start investing a person should have a large idle sum of money laying around. Then that person waits until they get this large sum of idle money that never arrives. For most people the best way to invest/save is to do it incrementally over time. Budget out a small portion that can be saved each month and have it automatically contributed to the savings or investment account. Then periodically evaluate and increase that contribution amount.

Below is an excerpt from an article I was reading the other day that ties into the above text.

If you think getting a late start saving for retirement of just six years is no biggie, think again. A 26-year-old who makes $40,000 a year, gets 2% annual raises, saves 15% of yearly pay and earns 6% annually on his savings would accumulate a nest egg of just under $1.2 million by age 65. If that person waits six years until age 32 to get started, his nest egg would total roughly $855,000. That’s $345,000, or almost 30%, less for missing just those initial six years. If our fictional 26-year-old holds off 10 years until age 36, the nest egg shrinks to $685,000, some $515,000, or nearly 45%, less than with the early start. As Gilbert says in the commercial, “This gap between when we should start saving and when we do is one of the reasons why too many of us aren’t prepared for retirement.” Walter Updegrave – Money.com

Now for some very grim numbers that a friend sent me in an email, he said this was pulled from a John Mauldin newsletter. I have seen slightly different numbers depending on the sources, but wherever they come from they always seem to paint a grim picture.

The average savings of a 50-year-old is only $42,000. The average net worth of somebody between 55 and 64 is $46,000. A couple at age 65 can expect to pay $218,000 just for medical treatment over the next 20 years. Eighty percent of people between 30 and 54 believe they will not have enough money to retire. One in three people have no money saved for retirement at age 65, and almost 40% are 100% dependent on Social Security.

Written May 2nd, 2016

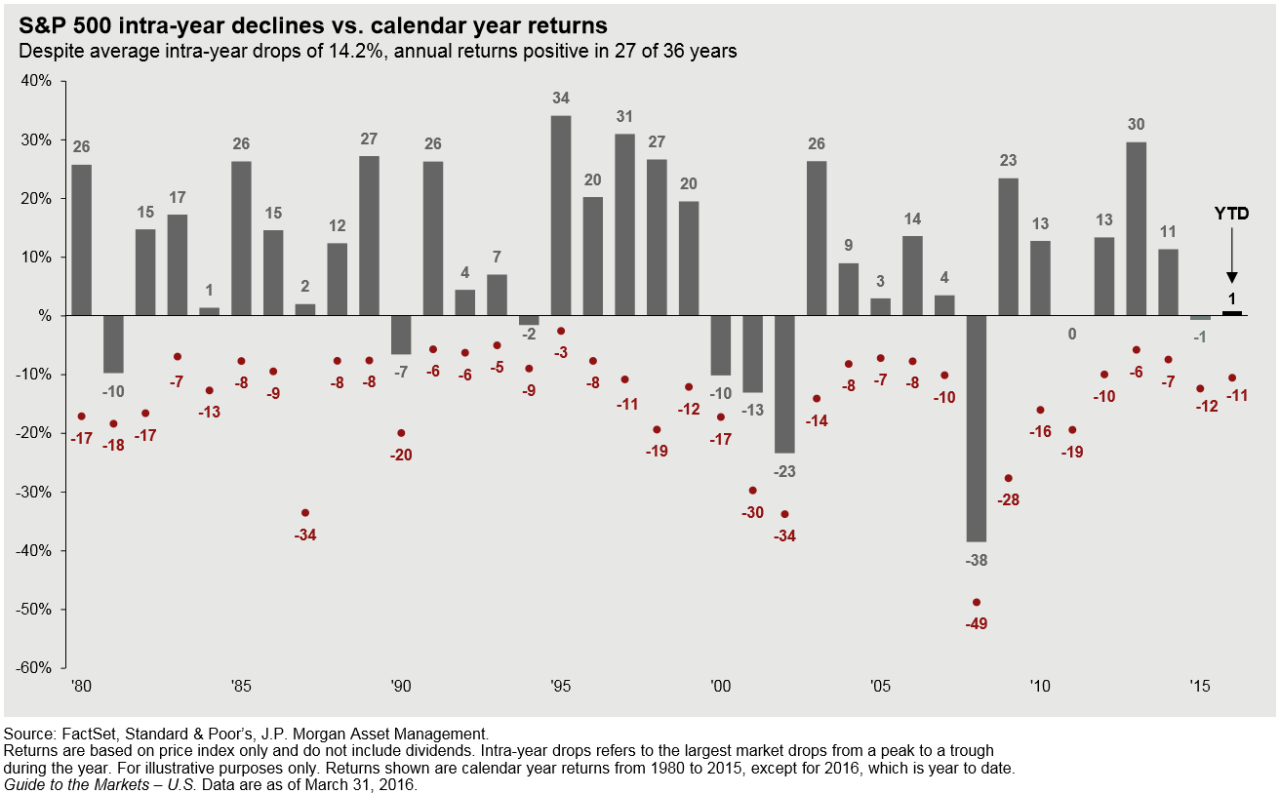

The graph above is very powerful stuff. It shows S&P 500 calendar year returns and the biggest intra-year declines that occurred. Notice that 27 of the last 36 calendar years had positive returns. Notice also that in many of those positive calendar years there were very big intra-year drops. This helps to illustrate that volatility is normal, and market corrections in the midst of a bull market is normal.

Written April 20th, 2016