Despondent: in low spirits from loss of hope or courage

In 1985, the super welterweight champion Thomas “Hitman” Hearns moved up in weight to fight middleweight champion Marvin Hagler. The match was billed as “The Fight” and it lived up to the moniker. It’s typically considered the best three rounds in boxing history. It was nonstop action and drama.

Coming into the bout, Hearns was known to have a knockout righthand punch. It was his ace in the hole that when landed cleanly would drop opponents.

From the onset, Hagler relentlessly and aggressively stalked Hearns, forcing action. Hagler’s pace turned the boxing match into a brawl. In doing this he opened himself up to Hearns’ knockout punch.

On que, Hearns landed his trademark straight righthand, but it did not have its previous effect. Hagler kept relentlessly coming. Despondent after throwing his best punch to no avail, Hearns was knocked out in the third round and carried out of the ring by members of his entourage.

Last week, stocks had a strong couple of days, but to no avail. They have since given those gains back and found new lows, again. At the start today (10/12/2022), global stocks were -25.53% year-to-date.

While markets were positive in 2021 on a calendar year basis, the bulk of the positive returns occurred in the first quarter. Taking that into account, stocks have had a hard go for quite a while.

There is a story in every boxing match and a story in every market. Last week’s market rally might have been a Hearns’ righthand punch.

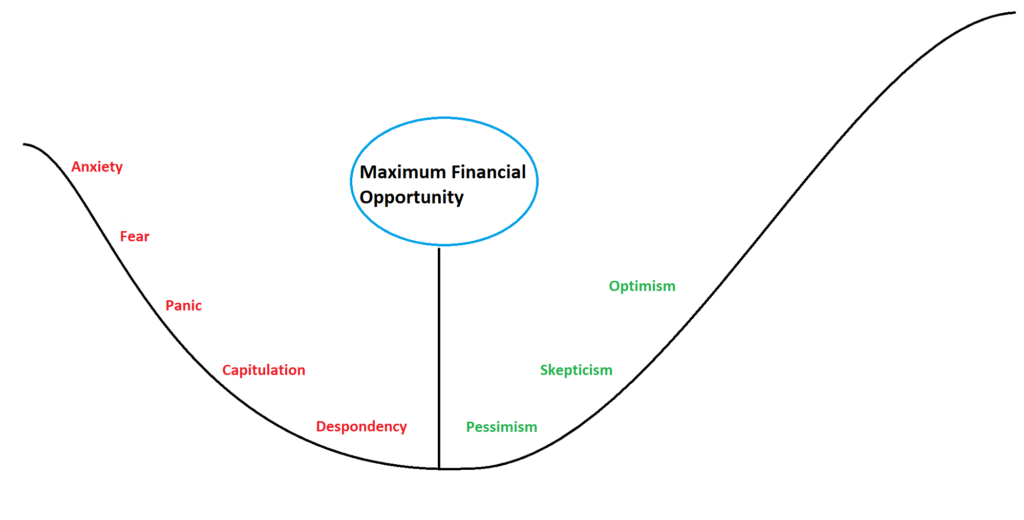

Boxing matches come to an end, but markets are perpetual lifecycles of death and rebirth. If investors are despondent, and markets are capitulating, then the death of this bear market is near.

Early last month, I wrote a Newsletter outlining the short-term headwinds against markets. This week Jamie Dimon, longtime CEO of JP Morgan recently painted a bleak outlook for stocks and the US economy.

I am speaking with investors daily, and would frame their sentiment anecdotally as very despondent. Lately, media has started to echo the sentiment of my investor conversations.

This intersection between investor sentiment and media is the biggest positive indicator since the start of the year, and it has me truly excited as an investor.

It’s easy to look back on 2000 and 2008 and see the great opportunity investors had, but capitalizing on it in the moment is hard.

“To buy when others are despondently selling… requires the greatest fortitude and pays the greatest reward.” Sir John Templeton

I am positioning portfolios to take advantage of the inherent opportunities and eventual rebirth of this market.

What are your thoughts on markets, economy, inflation, etc.? I’d love to hear.

Written – 10/12/2022

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

September 1st, 2022, is looking like another red day for stocks. As I write this the global stock market is down -1.50% and the US stock market (S&P 500) is down -1.08%. The rally in markets following mid-June lows appears to be evaporating. Leading many, including me, to believe we have yet to hit bottom for this bear market.

Classic bear markets follow a pattern of low, but somewhat steady declines over the course of several months. Then a sharp pronounced cliff drop at the end, stocks hit bottom, and begin an new bull market expansion cycle.

However, sometimes we see “bear market rallies.” This occurs when stocks hit bear market levels (down -20%), rebound, and then fall again to lower lows than before. I find these prolonged bear markets to be more painful, even if the magnitude of the declines is less.

In the 2000 Bear Market stocks declined -23%, rebounded +11%, declined another -22%, rebounded +7%, and then fell another -30% before hitting bottom. The total magnitude of the drop was -45% from the prior peak. It was painful and unique not just because of the percentage decline, but because of the length of time it took to bottom. Stocks began their decline in March of 2000 and did not hit bottom until September 2002.

As I write, markets have been challenging to downright terrible for 14+ months. It is psychologically draining to investors (which might lead to a true bottom).

Looking at the market over the short-term, under ~14-months, it helps to think of it as a weighing machine for positive and negative forces.

Negative Market Forces:

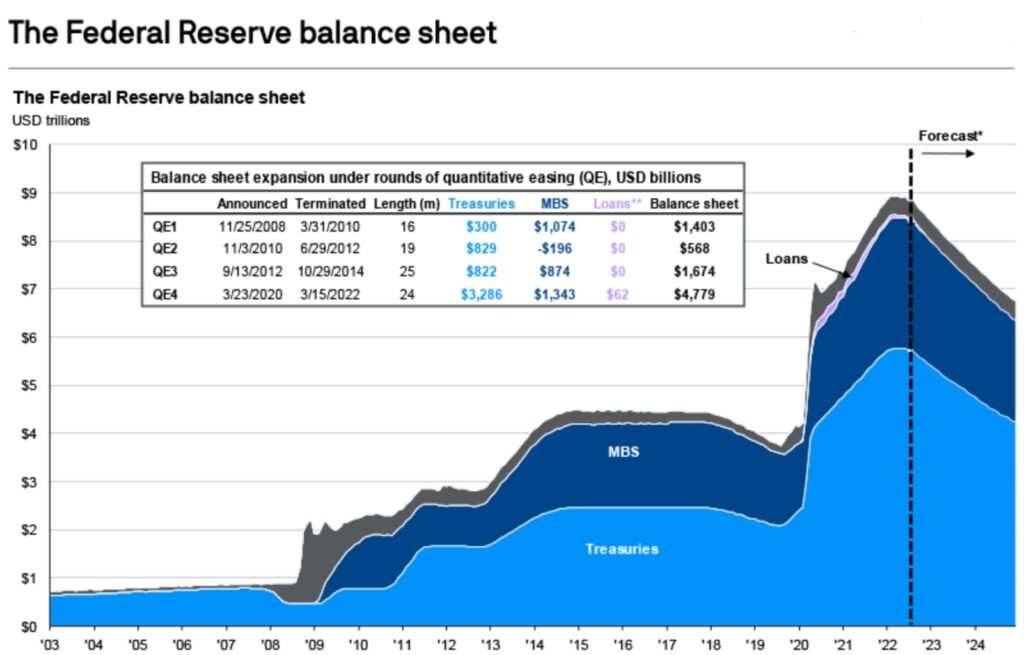

- Quantitative Tightening (QT) – Since 2008, the Federal Reserve (Fed) has been buying treasuries, and mortgage-backed securities. These purchases skewed the bond market and kept rates artificially low. As the Fed reduces and eventually stops purchases, the bond market will be free again. Rates should rise.

- Rising Rates – After spending over a year pretending there was no inflation, the Fed is trying to regain a shred of credibility by fighting inflation. Apart from QT, they are raising the Fed Funds Rate which effectively raises rates across the bond market.

- Recession & Earnings Revisions – The global recession is going to be a negative for markets until the data turns around. On top of macroeconomics, corporate earnings will probably be revised lower in 3Q.

- US Stock Valuations – Typically in bear markets, stocks bottom after they’ve reached cheap valuations. Starting the week US stocks were priced at 17x forward earnings. Lower earnings revisions will make stocks more expensive. My expecation is for stocks to hit 14x forward earnings (or lower) at bottom. That would mean prices have to come down, or earnings must go up. What do you think is more likely?

- Inflation – Over long-term periods inflation is a positive for stocks, becasue they are the only asset class that meaningfully provides significant ROI above the pace of inflation. In the short-term inflation is crippling for economies, and a negative force for markets.

Positive Market Forces:

- Stocks Go Up – At all times, broadly buying stocks is a sound investment long-term. The market is always long-term bullish. It is only a question of time. For that reason, investors should always have a bullish bias. Even today, as I’ve painted a dour picture for stocks in the short run, the probabilities of positive returns over the next 14+ months are very high.

Positioning investment portfolios requires knowledge of several factors that are unique to each individual investor.

That said, in my managed portfolios we favor value vs. growth stocks, we are tax-loss harvesting in taxable accounts, and using the green days in the market to reposition into a more defensive stance. We are holding a higher weighting to cash, and waiting for the inevitable bull market to come.

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

Capital markets, where to even begin? It has been a challenging ~12-months for stocks. Going back to summer 2021, we saw stocks trade in a tight range, taking one step forward, only to then take two steps back. Then, from November on global stocks fell more aggressively, hitting lows of more than 19% down. Several major stock market indices such as the Russell 2000, and the NASDAQ have crossed the -20% threshold into official bear market territory.

It remains to be seen if markets have hit bottom, or how much bleeding is still to come.

Currently, there is a crowded field of market drivers, investor sentiment which is always the paramount driver over the short-term, the fallout and potential escalation of the Ukraine vs. Russia War, INFLATION, Fed policy, lockdowns in China, and now economic recession.

Let’s start by looking at YTD performance (as of 5/18/22) of major capital market indices and a chart for global stocks.

- Global Stocks: -17.06%

- US Stocks: -17.24%

- International Developed Stocks: -15.26%

- US Aggregate Bonds: -9.52%

Investor Sentiment

When there are more buyers than sellers, stocks rise, and the converse is true. Investor outlook is influenced by all the other above-mentioned drivers, but ultimately it is the buying vs. selling sentiment that moves prices in the short-term. In an environment where all major drivers appear negative there are numerous opportunities for the story to shift positive and change the market direction.

Ukraine vs. Russia War

Initially when Russia invaded Ukraine, there was fear of escalation and the potential for a nuclear WWIII. While that risk remains, the probability is very low, and a more known quantity. The economic fallout from the conflict is complicated to calculate and predict. It is not as easy as subtracting the economic output of Ukraine and Russia from the world equation like one could remove a puzzle piece. The interconnectivity of global economies are vast, and the ripple effects of each action are essentially endless. That said, once the war broke out economies immediately started to adjust and adapt based on the new environment. Free economies are nimble, highly resilient and may adjust to this new environment better than initially expected.

A longer-term effect of the war might be a reduction in the use of US dollars as preferred reserve currency. If the US Gov. is willing to use the dollar as a means by which to manipulate and force the hand over foreign governments as it has with Russia, then other foreign governments (& entities) may explore alternative options. In theory, if the US dollar were to decrease in reserve currency status, it would weaken the dollar vs. foreign currencies. This could result in a positive effect for American workers and domestic production, while simultaneously increasing consumer costs (higher inflation), and decreasing available credit to individuals, businesses and government. For investors it would increase the attractiveness of international stocks.

Is war good for the economy?

No. There are beneficiaries in war, but as an aggregate war is an economic negative. It forcibly reallocates capital and resources. Additionally, war comes with destruction of property and human destruction. This means that capital and time that otherwise would have gone to some other new positive production, instead goes to rebuilding, and the dead are lost forever. Economists refer to this myth as the broken window falsely. Think about your home. If all the windows in your home were suddenly broken from vandalism or natural disaster and they needed to be replaced this would not be a positive economic development. Sure, the window company might benefit from the job, and the new windows might even be better than the old ones, but the money, time, and labor used to replace all the windows would have been better served elsewhere. Even if something is rebuilt/remade better than it was before the destruction, the cost of that destruction is always negative in real terms.

Inflation

Inflation numbers continue to come out, and the story mostly remains the same. Inflation is very high, and therefore, purchasing power continues to erode at a rapid pace. There is some recent evidence that the pace of inflation may be slowing. However, slowing inflation when the starting point is all-time highs is not much consolation for Americans in the grocery store or at the gas pump. For a more detailed take on inflation see my previous two newsletters: Will Prices Keep Going Up in 2022? & Inflation 2.0. In the short-term inflation is a negative force for stocks, bonds, consumers, companies, etc., etc. There are some beneficiaries of inflation though, namely commodity prices, and debtors. The biggest beneficiary of inflation is the Federal Gov., because it is the world’s greatest debtor. Over the longer-term stocks remain the best returning asset class after adjusting for inflation, even if prices are reset lower in the short. Value stocks, tend to outperform growth in inflationary environments.

Fed Policy

After spending 2021 denying the existence of inflation, then insisting it would be temporary, now the Fed insists it will fight and end inflation. They intend to raise the Fed Funds Rate by 0.25-0.5% incrementally, while also ending QE Treasury purchases. I read their intentions as hoping with time inflation will cool itself. Chairman Powell recently said that he admired Paul Volcker (Fed chairman 79-87) not because he aggressively raised rates and fought inflation, but “because he did what he thought was right.” It seems likely that chairman Powell might believe a different course of action is “right.”

A case for Bottom

If you believe as I do, that we are amid a recession, and the late-July report will only confirm it; then history would tell us that we are near a market bottom (if we haven’t hit it already). The stock market cycle tends to lead the economic cycle, whence why it is referred to as a ‘leading indicator.’ This is not to say that markets can’t fall an additional 10+% from current levels. The point is that if markets have not hit bottom yet, they likely will over the next ~40 days.

Theme Changes

When looking at history we find that market cycles tend to have sweeping macro characteristics that play out for long stretches, I refer to these as themes. There have been long periods of outperformance by Japanese stocks, US large growth, US tech, International DM, emerging markets, etc. vs. the relative market. Typically, those periods of outperformance are followed by relative underperformance and the emergence of a new leading category. I believe a transition to new leadership is taking place. Post 2008 US large/mega-cap growth stocks have had tremendous outperformance relative to the broader market. This has led to multiple expansion in those stocks, and big spread between other category multiples vs. US large growth. Below you will see the forward price-to-earnings ratios for these major categories of stocks, coming into this week.

- US Growth 23.5x earnings

- US Value 14x earnings

- International Developed 12.5x earnings

- International Emerging 11x earnings

The mean for US growth over the last 20-years is 18.5x earnings. This tells me growth may have further to fall, despite being -23% YTD already. By contrast US value stocks YTD performance is -6%.

When markets fall and the world appears to be in chaos our human nature works against our investor best interests. Our nature is emotional, and our emotions trigger our fight or flight instincts. In these times it is more important than ever to remain calm and revisit our investment policy. Lean on a clearly defined set of principles and process for making decisions.

Be well,

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com