2016 marked the first full calendar year for W. Swartz & Co., and by reaching that milestone I am able to review portfolios and give a report card for how portfolios did relative to their benchmarks.

Overall I can say that I am very pleased with how client portfolios performed.

Benchmark for stocks portfolios: Vanguard Total World Stock ETF (Ticker: VT): +8.51%

-

About the Benchmark: VT is an ideal benchmark for the world stock market. It is a global stock index fund that covers approximately 98% of the world’s investable market capitalization. About 50% of the fund’s portfolio is invested in U.S. stocks, 40% in international developed stocks, and the remaining 10% in emerging-market stocks.

Benchmark for fixed income portfolios: SPDR Bloomberg Barclays Aggregate Bond ETF (Ticker: BNDS): +2.37%

-

About the Benchmark: BNDS provides a measure of the performance of the U.S. dollar denominated investment grade bond market, which includes investment grade (must be Baa3/BBB- or higher using the middle rating of Moody’s Investor Service, Inc., Standard & Poor’s, and Fitch Inc.) government bonds, investment grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and asset backed securities that are publicly for sale in the United States.

BRAVO: +10.23% (after fees)

-

About this Portfolio: This portfolio is 100% stocks and used in accounts I manage where the client has below $100,000 allocated to stocks. It will mirror the WSTR portfolio in theme, but with fewer holdings.

-

Why the Outperformance?: The BRAVO portfolio performance was generally helped by opportune buying after cash had accumulated within the accounts. The majority of my clients that are invested in the BRAVO portfolio make contributions throughout the year. More than the individual holdings, client’s portfolios seem appear to have benefited from well-timed trades. Additionally, when a portfolio has less holdings and some of those holdings outperform the impact is greater than in a portfolio with more holdings.

-

Conclusion: Tactically timed trades can help lead to outperformance.

W. Swartz Total Return (WSTR): +6.8% (after fees)

-

About this Portfolio: This portfolio is 100% stocks and used in accounts I manage where the client has about $250,000 allocated to stocks. It is the flagship portfolio of W. Swartz & Co.

-

Why the Underperformance?: An underweight to emerging markets relative the benchmark. Historically emerging markets have underperformed developed markets in the late stages of bull markets & early stages of bear markets. While we cannot say how much longer this bull will run & past performance does not predict future performance it seems reasonable that this trend will play out again. I expect as sentiment in the markets improves & more money flows into stocks that chose dollars will gravitate towards seemingly more safe stocks of big blue chips in developed nations. Additionally I expect assets which are less broad & perceived riskier to underperform during the next bear market cycle. In markets it’s always better to be a bit early to the party than fashionably late.

CORE Fixed Income: +4.22% (after fees)

-

About this Portfolio: This portfolio is 100% fixed income correlated securities. Meaning that it may not be invested in individual debt securities, but rather pools of debt securities in the form of ETFs &mutual funds. This portfolio uses the Barclays Aggregate Bond ETF as a benchmark.

-

Why the Outperformance? An overweight to high-yield & corporate bonds vs the benchmark led to considerable outperformance in fixed income portfolios for 2016. Moving forward in what is likely to be an environment where rates rise faster than in 2016 I expect lower duration bonds to be an important factor in fixed income portfolios.

Summary: In a world where average investors drastically underperform the asset classes they hold, I am excited to say that my clients achieved market like or better than market returns in their portfolios for 2016.

Wyatt Swartz

2/1/2017

It is my expectation that in 2017 the stars finally align and we see a rising interest rate environment that we have been anticipating for over 5 years. It is my expectation that the combination of economics, Fed monetary policy, the new administration’s fiscal policy will lead to create that scenario.

Longer duration bonds are more sensitive to interest-rate changes, and have performed worse in rising rate environments historically. Additionally government bonds tend to be more sensitive to rising interest-rates and have historically underperformed corporate bonds during rising rate environments.

Underweights for 2017 (Fixed Income)

-

Long-term to Intermediate Bonds: As interest-rates rise, bond prices fall. This is most true for longer duration bonds.

-

Treasuries: Government bonds have the lowest degree of credit risk, and the highest sensitivity to interest-rate risk. If the US and global economies continue the expansion in 2017 and the Fed raises rates as expected, government bond prices will likely be hit the hardest.

Overweights for 2017 (Fixed Income)

-

Short-term Corporate Bonds: The low duration reduces price risk associated with interest rates. Also, corporate bonds have higher yield spread vs. government bonds which provides more income to offset losses from declines in bond prices associated with rising interests rates.

-

High-yield Bonds: Historically high-yield has outperformed relatively in rising rate environments. Improving fundamentals and rising rates leads to lower defaults. On a basic level, high-yield has less interest rate risk and higher credit risk. Meaning that high-yield is more likely to default, and default risk naturally decreases in rising rate environments.

-

Floating Rate: Bank loans do well in environments where corporate credit improves. Bank loans typically adjust coupons every 90 days which makes them very defensive to rising interest-rates.

– Wyatt Swartz

Written 1/17/2017

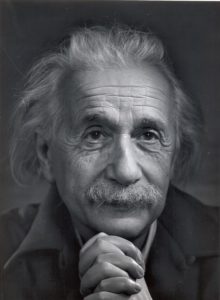

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

– Albert Einstein