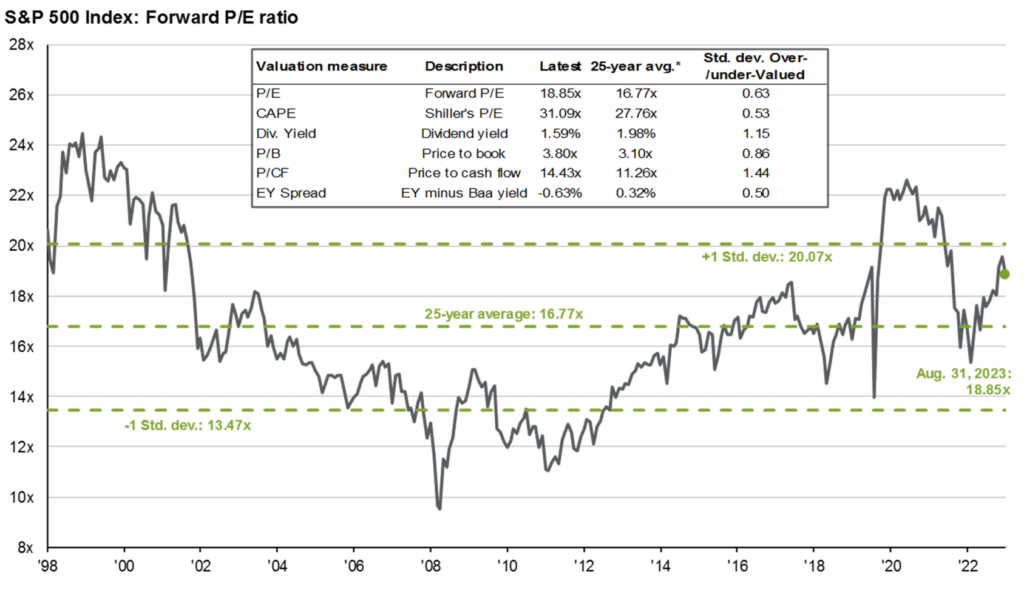

At around 4,516 (today the S&P closed at 4,259) the S&P 500 is priced at 18.86x forward earnings. As seen below, the 20-year average is 16.77x, and 20.07x would represent a full standard deviation above average.

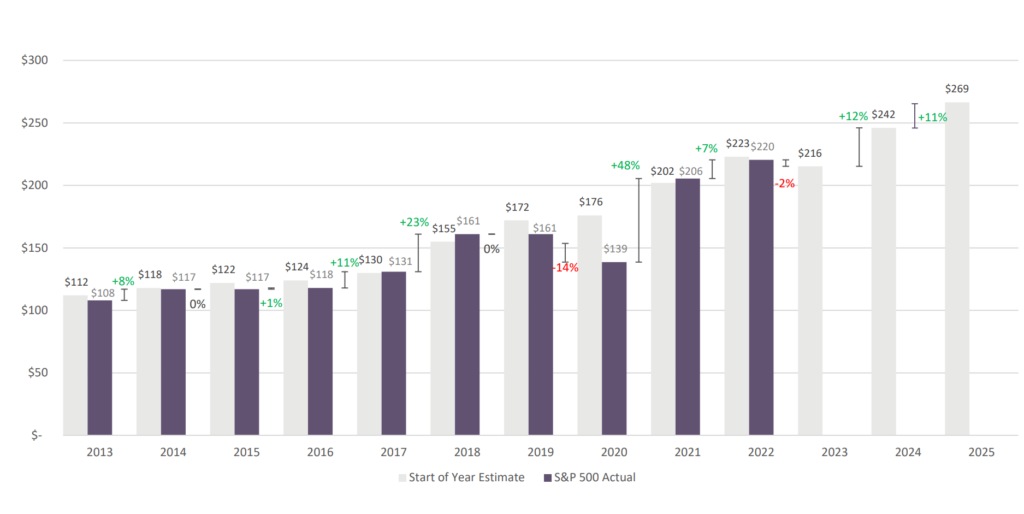

The earnings per share forecast is about $240 for the S&P in 2024 as seen in the chart below.

When you compare prior year forecasts, you will find they tend to be slightly more optimistic than reality in times of economic expansion. However, when recessions occur EPS typically decline below prior forecast. The median decline for earnings during recessions is 13%. That would imply S&P earnings of $209/per share.

We cannot say if there will be a recession in 2024, or if there is, that EPS for the S&P 500 will actually fall by 13% below forecast.

Taking into account that the gravitational force of the market pulls it up over time, we should still ask three questions regarding the US stock market.

- Do we believe markets will mean revert back to historical ratios of price to earnings?

- What is the probability for US recession in 2024?

- If recession occurs in 2024, what do we expect EPS to be for the S&P 500 compared to our $240 forecast.

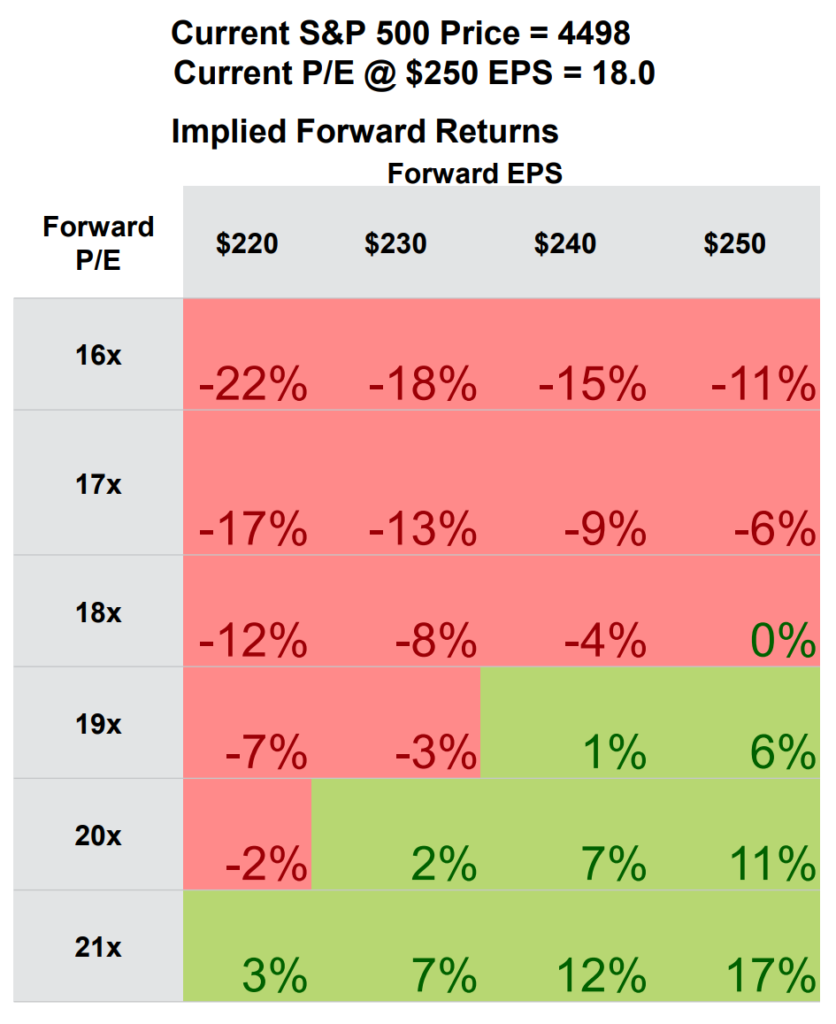

I call the above chart, “choose your level of optimism.” It shows that at a ~4500 starting point, if EPS were $250, and 18x P/E held true there would be a 0% gain. From there you can adjust to see the implied return based on EPS and P/E.

Example, if you expect $230 EPS, and for P/E to come down to 17x the implied return would be -13% (with 4500 as starting point, today’s level = 4258). I must apologize for outdated data; US stocks have fallen about 5% from mid-September when I started writing this. While the data is somewhat lagging, the concepts remain pertinent.

Markets of course are not as rational as the math I’ve presented above. There are many other forces that will impact the markets beyond the mathematics.

Thankfully, there are a number of attractive options for investors concerned with the math in US stocks. Please reach out if you would like to discuss.

To the W. Swartz & Co. private clients, I hope to send out an email next week summarizing actions we are taking to hedge against downside forces while continuing to participate in upside gains.

Sincerely,

Wyatt Swartz

Written October 5th, 2023

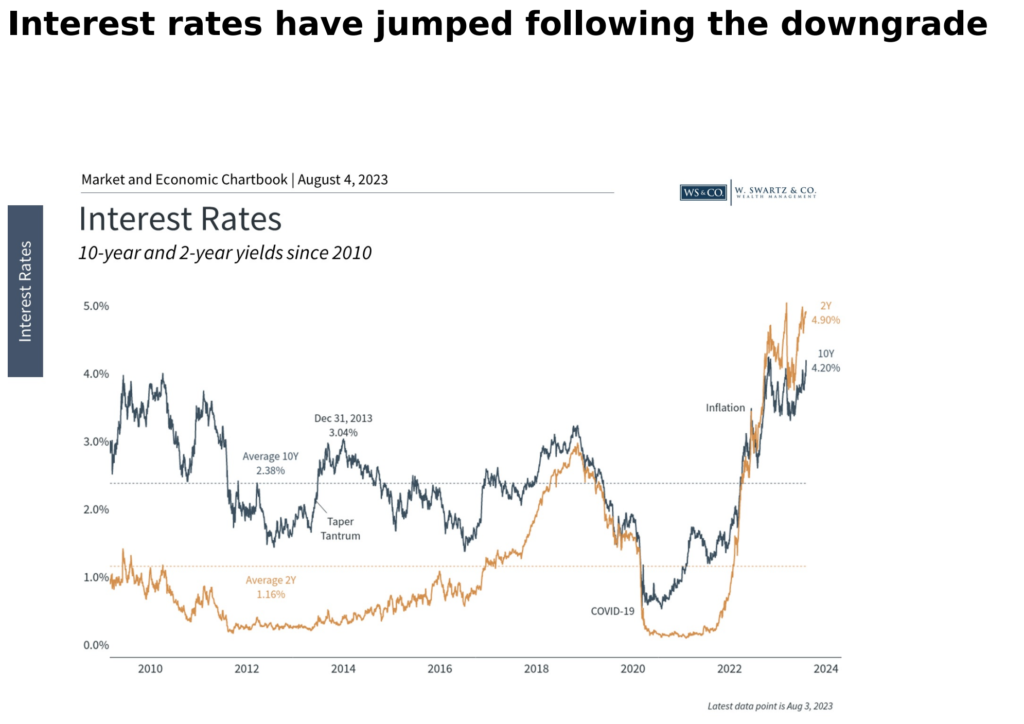

On August 1, Fitch, a credit ratings agency, downgraded the U.S. debt from AAA (the highest rating) to AA+. Fitch had warned of a possible downgrade during the debt ceiling crisis earlier this year and has sounded alarms since 2011 when a similar crisis occurred. Most do not see the downgrade as meaningful, AA+ still represents an extremely low default risk, that does not mean it has not impacted capital markets. What drove the downgrade of the U.S. debt and how can long-term investors maintain a balanced perspective?

The national debt is rightfully a source of investor worry but this has been the case for decades. While I would argue the downgrade is warranted, the puzzling nature of this is related to timing.

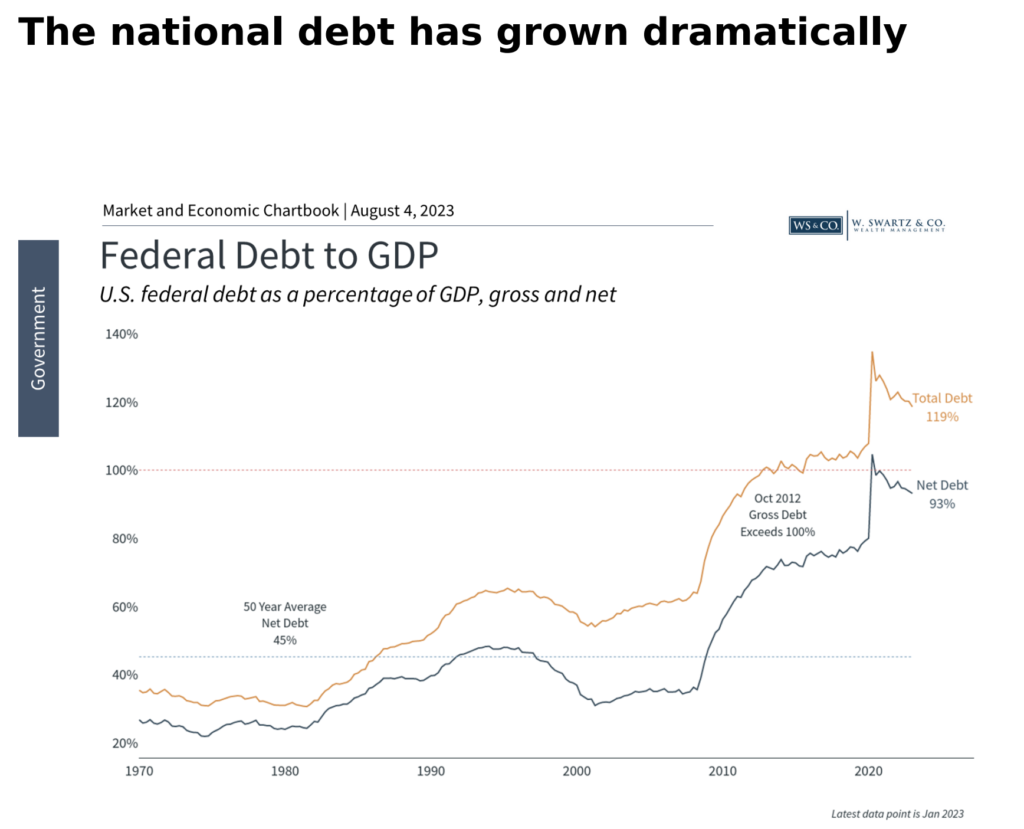

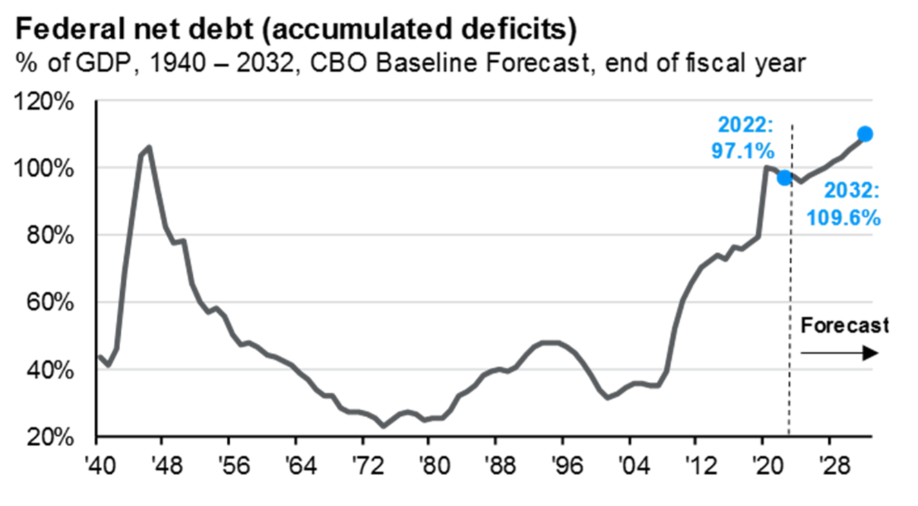

It’s no secret that the level of the national debt has grown considerably in recent years, from $9 trillion in 2008 to over $31trillion today. As a percentage of GDP, debt levels have risen to nearly 120% in total and 93% if inter-governmental debt holdings are excluded (i.e., debt one part of the government owes to another). Regardless of how you slice it, debt levels have risen dramatically with little end in sight.

Unfortunately, there are few examples of the federal government running surplus. This last occurred during the dot-com boom, before that, in the early 1970s during Nixon’s administration.

The U.S. now has ratings of AAA from Moody’s, AA+ from Standard & Poor’s, and AA+ from Fitch. Only nine countries, plus the European Union, maintain the top ratings across the three major credit ratings agencies, including Germany, Switzerland, Australia, and Singapore.

Why does this matter? Despite periods of brinkmanship, the U.S. has never defaulted on its debt. Meaning that the US Gov. has always paid its debts with any agreed upon interest. Albeit with devalued dollars in most cases post 1908. The global financial system is built on the premise that Treasuries are unquestionably “risk-free.” While the situation is still evolving, the immediate impact of the downgrade has been higher interest rates.

There are some parallels to the summer of2011, almost exactly 12 years ago to the day, when Standard & Poor’s was the first credit ratings agency to downgrade the U.S. debt.

During that period, the US stock market fell into correction territory with the S&P 500 declining19%. Ironically, the prices on Treasury securities increased during the 2011 debt ceiling crisis because, even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. The debt ceiling was eventually raised, and a new budget was approved. Markets eventually bounced back and reached new all-time highs only six months later. At the time, the market reaction was not only difficult to predict, but was unintuitive to many.

So, what does the latest U.S. debt downgrade mean for investors? In truth, nothing has changed in recent weeks regarding the health of the economy or the long-term fiscal situation for the country. This is a symbolic move by Fitch, an appropriate move, but still symbolic.

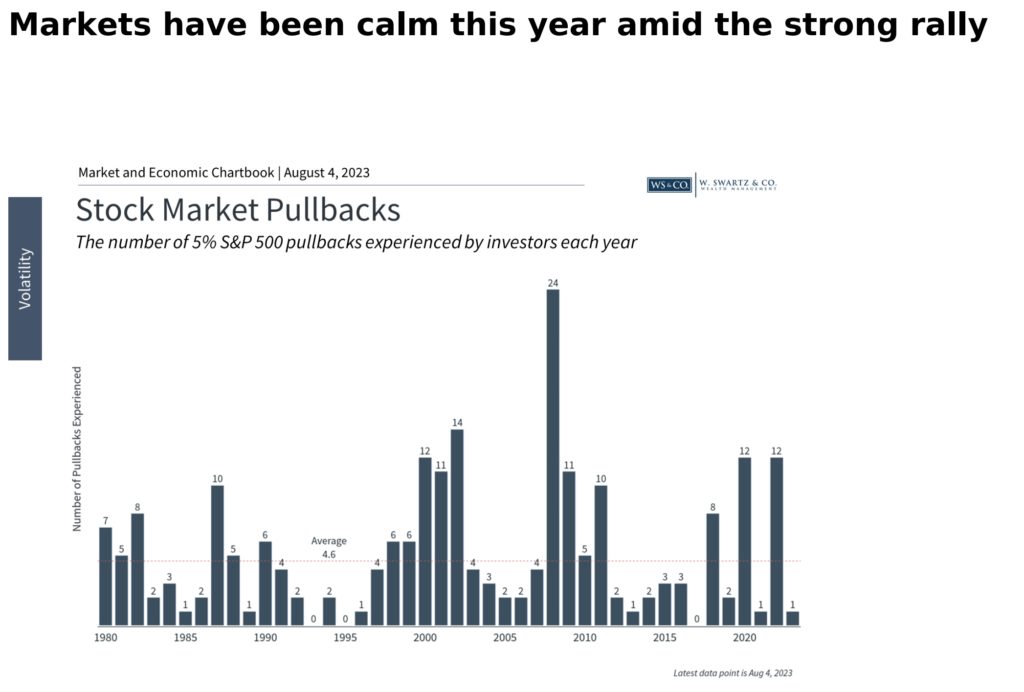

The accompanying chart shows that there has only been one pullback of 5% or worse this year which occurred in March during the Silicon Valley Bank, and Signature Bank failures, compared to the average year which experiences several.

Two long-term debt concerns that some investors often have are the growing interest payments on the national debt and the reliance on foreign borrowing. Neither has a simple solution. The fact that interest rates have been and remain relatively low compared to history has helped to keep these payments manageable. When it comes to our foreign dependency, over 75%of the U.S. debt is still held by American households and institutions, compared to foreign holdings of 3.5% by Japan, 2.7% by China, 2.1% by the U.K., and so on.

The national debt and the fiscal standing of the U.S. matter for many reasons. But from an investment perspective, the irony is that the best times to invest have been when the deficit has been the worst. These periods coincide with the most attractive prices and valuations. Ultimately, history shows that investors are rewarded for investing when others are fearful.

The bottom line? Although the Fitch downgrade is impacting markets, it is based on factors with which investors are already familiar. Fitch is acknowledging the fact that the US Gov. is unlikely to pay its debts without creating more inflation. While inflation is negative for most capital investments in the short-term (see 2022), over the long-term stocks benefit from inflation. Corporations are nimble and their profits, dividends, revenues, prices, etc. all go up to reflect the new value of money in real terms. The same is true for share prices.

Sincerely,

Wyatt Swartz

Written August 4th, 2023

2022 was a dreadful year for investors. I think most investors are acutely aware of the ~recent pains occurring in capital markets. However, I venture to guess most are unaware of the how unique and truly rare the year was.

US stocks, international stocks, and the US aggregate bond market were all negative for the year.

- US Stocks -18.14%

- International DM Stocks -14.27%

- US Investment Grade Bonds -13.06%

Going back to 1980, there were ZERO calendar years where the broad US stock & bond market both had negative returns. The last time this occurred ~might have been in 1969. I say might, because I do not have perfect apples to apples data going back that far. At any rate, we experienced an extraordinarily rare year in capital markets, a year unlike any in at least 53 years.

There is value in understanding and remembering how rare last year was when creating a forward looking investment outlook. However, it would be a grave mistake to take the recent pains and extrapolate similar results over future short and long-term periods.

With that, let’s move the conversation to our outlook.

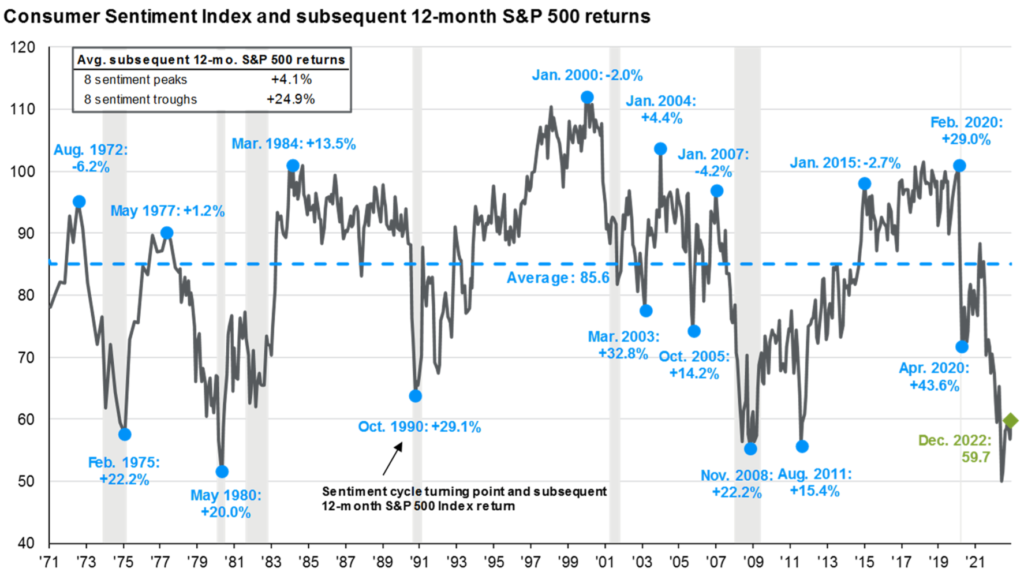

The combination of negative market performance and a slowing economy has investors understandably negative. However, as I outlined in a previous newsletter, despondent sentiment typically precedes strong market performance. Below you can see that troughing consumer sentiment is followed on average with +25% returns over following 12-month periods.

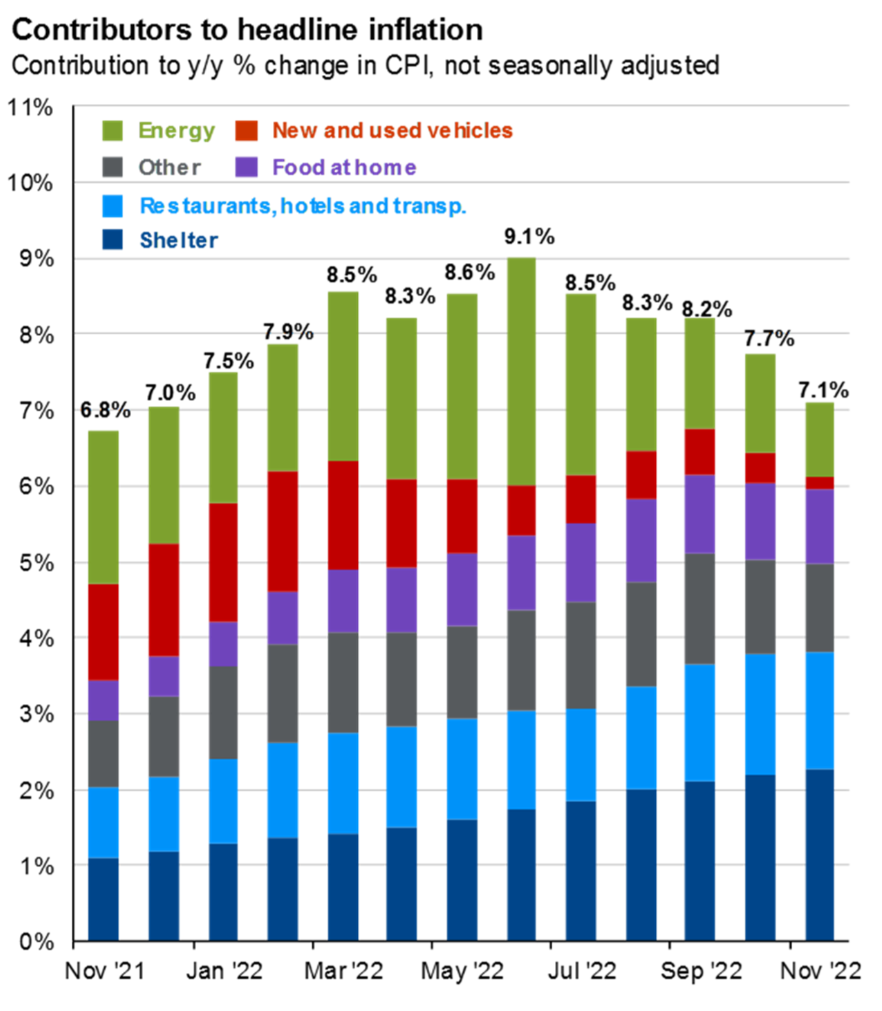

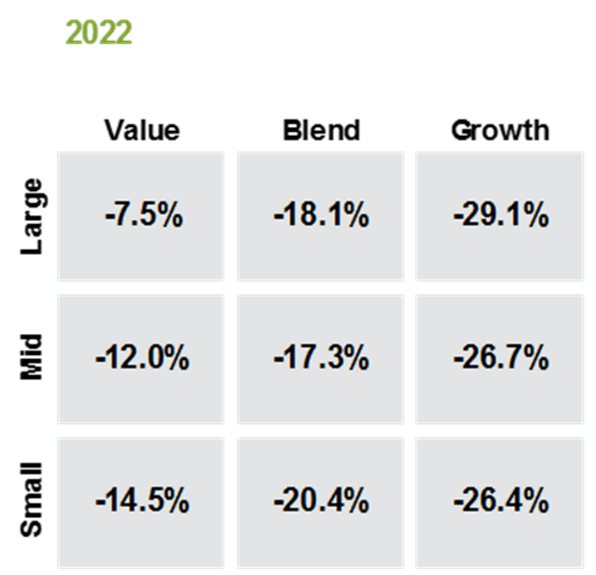

We are early stage of a period characterized by high but falling inflation. This will continue to favor dividend paying value stocks. I am happy to say WS&CO made a shift from neutral to value weighting within stocks going back to 4Q2021. Below you can see inflation numbers peaking last summer and slowly trending lower and the disparity between Value vs. Growth stocks investment returns in 2022.

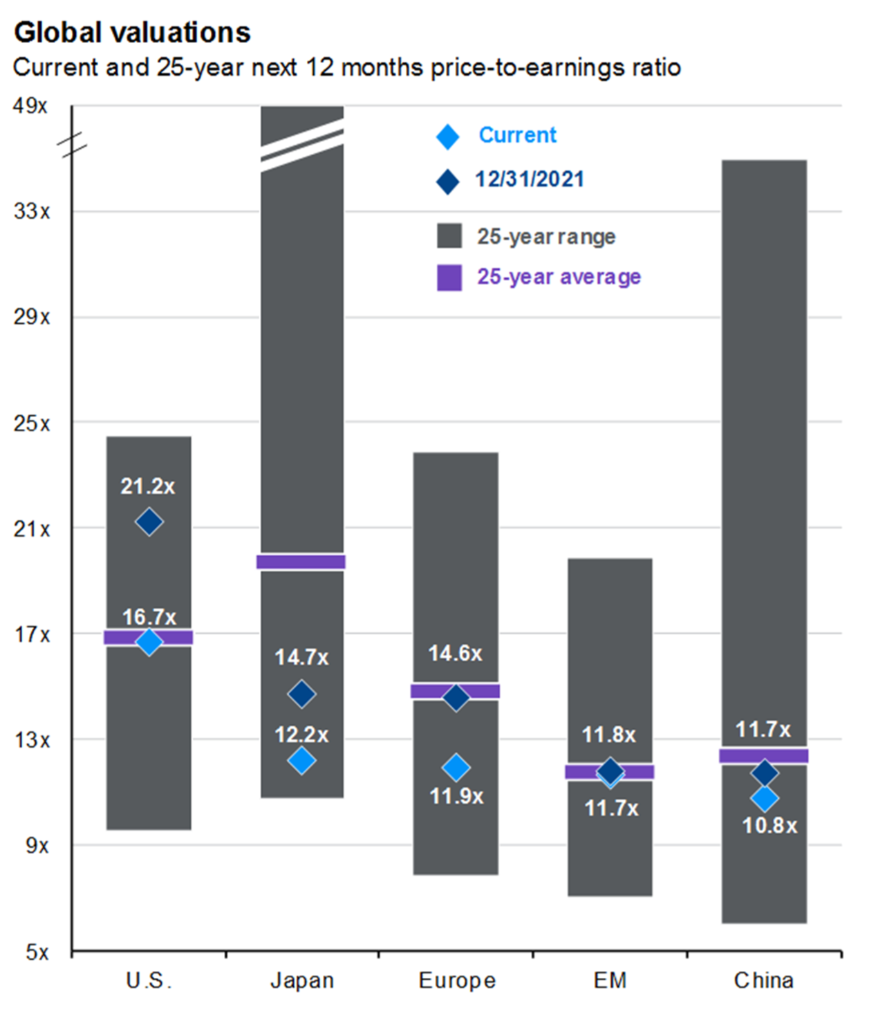

At the start of 2022 US stocks were pricey by historical measures. Today, US stocks are more attractively priced and international DM stocks are cheap by historical measures. This bodes well for stock returns moving forward, especially international stocks. Below you can see US stocks back in line with long-term averages for price-to-earnings as measured by the light blue diamond, and Japanese and European stocks well below historical averages.

The combination of trade & budget deficits, rising government debt loads, and monetary tightening globally point to a weakening US dollar in both the short and long-term. A weakening US dollar is more rationale for diversification to international stocks. Below you can see Federal debt as percentage of US GDP at highest levels since the late 1940s, and the US dollar with strength comparable to when the US Gov. had a nearly balanced budget.

Falling inflation, a Fed pause to interest rate hikes, and a better starting point for asset prices should combine for a much better tasting cocktail in 2023. It would be unwise to expect rarities 2022 to continue indefinitely.

Any thoughts or questions? Please share, I’d love to hear them. Hope you had a wonderful holiday season, cheers to a new year!

Wyatt Swartz

Written January 11th, 2023