Have a plan. Follow the plan, and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

Have a plan. Follow the plan, and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

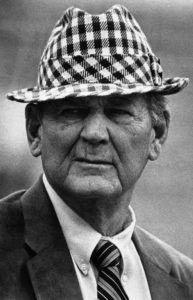

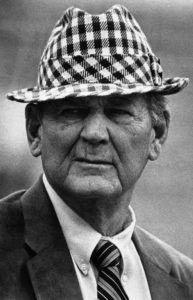

— Bear Bryant

Have a plan. Follow the plan, and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

Have a plan. Follow the plan, and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

— Bear Bryant