Skip to content

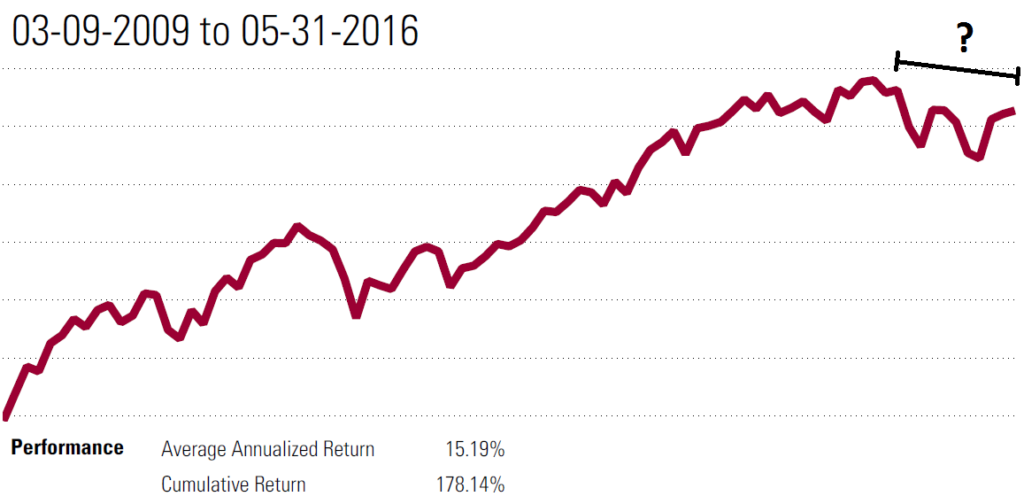

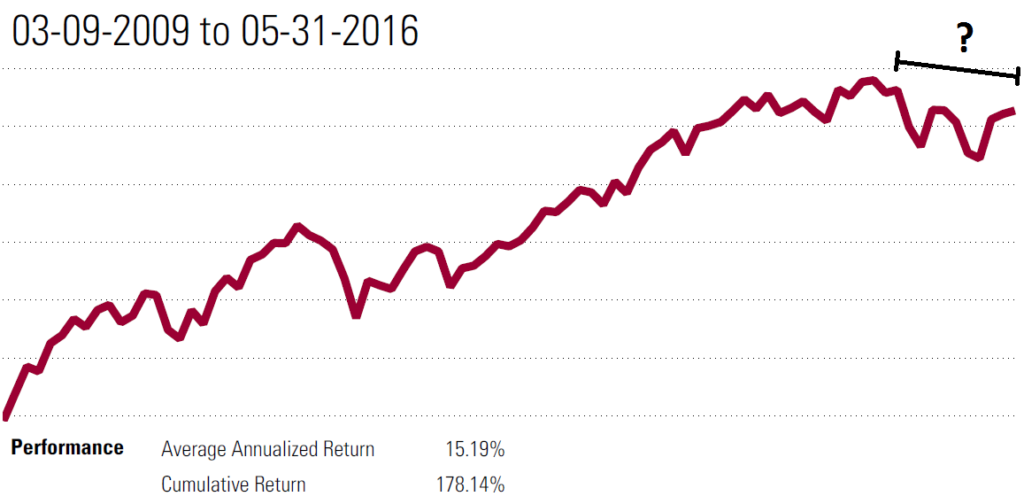

Graph: Vanguard Total World ETF (VT) since the start of the bull market on February 9th, 2009 (return data includes dividends)

Graph: Vanguard Total World ETF (VT) since the start of the bull market on February 9th, 2009 (return data includes dividends)

What should we call the recent market history? Maybe we should call it a mini bear, a pause, a stall, or perhaps a flat line. Really it is too early to say, as it is still unclear if this is a pause within the greater bull market or early stages of a bear market.

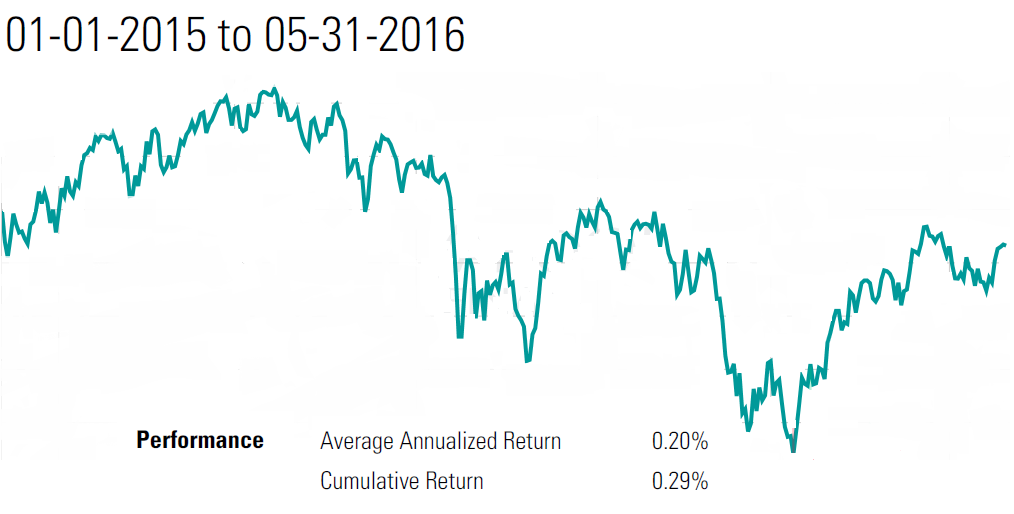

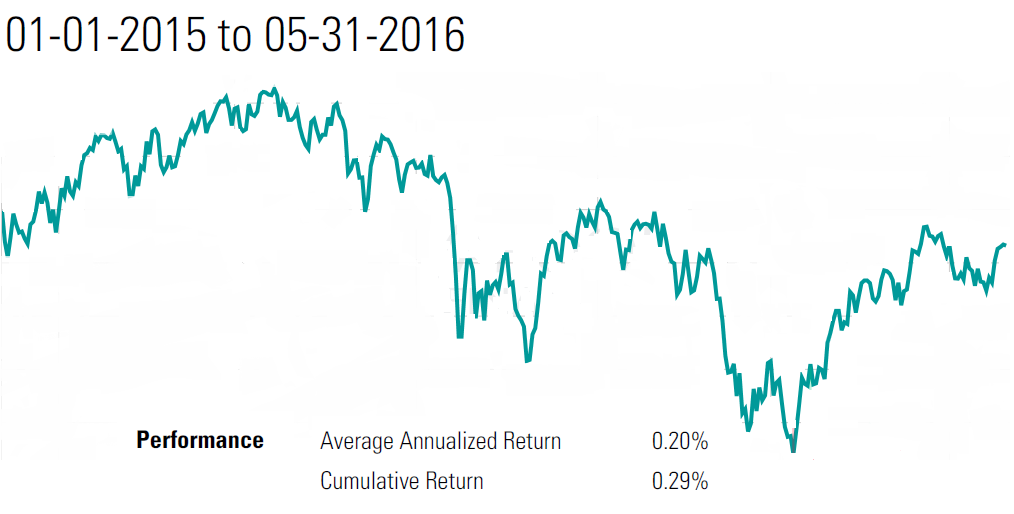

The markets have been stalled going back to 2015. The chart above shows the market since the beginning of the bull run in 2009, and the chart below shows the market since the start of 2015 and its relatively flat performance. Why has the market been so flat over the last ~year?

Economic Drivers: Recession still appears unlikely, however increased rates of expansion appear equally unlikely. Growth has remained low, and relatively in line with expectations. Developed economies continue to expand between ~1.5% – 3% and there seems to be little indication of an oncoming change.

Political Drivers: Since the start of the “summer of Trump” political stalemate in Washington has continued. The political inaction was a positive force for the market, however uncertainty about the future environment rose which was a negative force on the market. The “smart money” liked Marco Rubio or another mainstream candidate like Jeb Bush or Scott Walker to be the republican presidential nominee, but Trump won. The “smart money” expected the Hilary Clinton machine to win the democratic nomination in a landslide, but instead self-proclaimed socialist Bernie Sanders took her down to the wire. The November elections seem to truly be a situation where anything could happen, and that uncertainty makes it difficult to be bullish or bearish.

Sentiment Drivers: Investors and general population alike appear somewhere in the pessimistic to skeptical stage of the sentiment life cycle. Sentiment has seemingly remained in line with expectations of low economic expansion numbers.

The market seems to have paused as major drivers remained collectively neutral. It is difficult to say the timing for when the pause will end. The positives and negatives continue to cancel one another out. Over short-term periods expect the market to remain wildly volatile, with upside and downside corrections likely.

Eventually there will be a major disconnect between expectations and reality which will push the market.

Either way, right now there is not enough evidence to support forecasting a bear market or moving a portfolio to a defensive position. When in doubt, remain bullish and take comfort in knowing that the most dangerous investing move is betting against the market. Take comfort in knowing that the superior long-term returns of stocks does not exclude the down periods, it accounts for the ups and the downs.

Graph: Vanguard Total World ETF (VT), date range 01/01/2015 – 05/31/2016 (return data includes dividends)

Graph: Vanguard Total World ETF (VT), date range 01/01/2015 – 05/31/2016 (return data includes dividends)

Graph: Vanguard Total World ETF (VT) since the start of the bull market on February 9th, 2009 (return data includes dividends)

Graph: Vanguard Total World ETF (VT) since the start of the bull market on February 9th, 2009 (return data includes dividends) Graph: Vanguard Total World ETF (VT), date range 01/01/2015 – 05/31/2016 (return data includes dividends)

Graph: Vanguard Total World ETF (VT), date range 01/01/2015 – 05/31/2016 (return data includes dividends)