The Federal Reserve’s interest rate decisions remain the central focal point for markets. The timing and size of rate cuts are the subject of debate, but why the bank is cutting rates and how the full rate cut cycle might playout are far more important. The implications are not as straightforward as they might seem, and market expectations have shifted dramatically over the past year. What should investors know about how rate cuts have historically impacted the economy and markets?

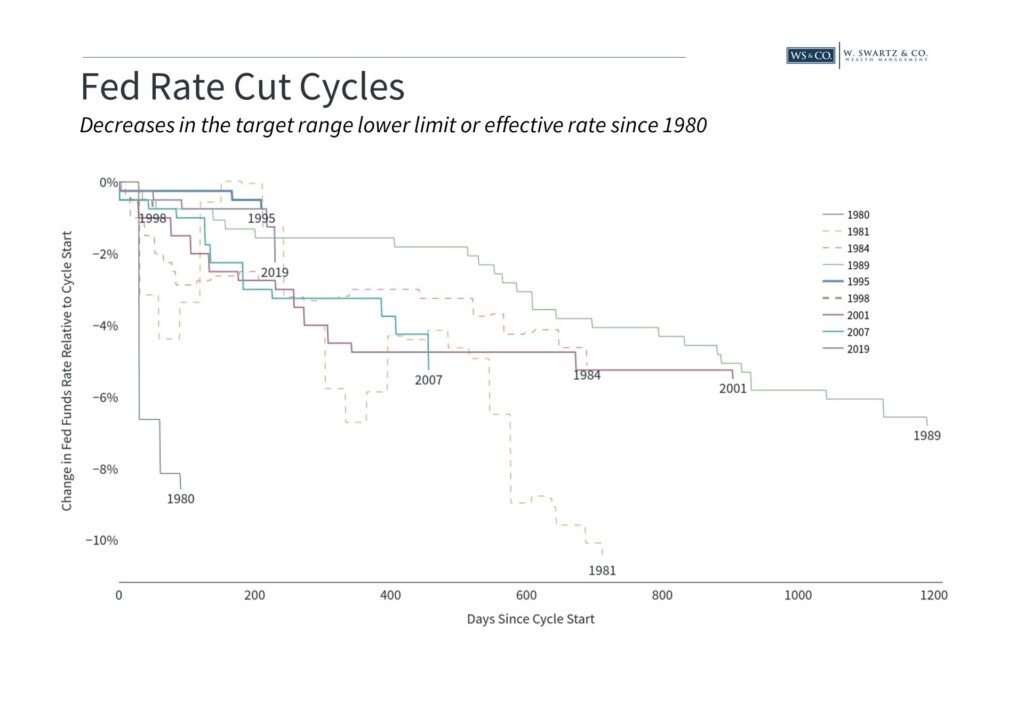

The Fed typically lowers interest rates in response to a weakening economy, because makes borrowing cheaper for individuals and companies, while also increasing the incentive to spend rather than save. In theory, this boosts growth and supports the economy, especially during recessions and financial crises. Over the past few decades, the Fed made dramatic rate cuts during the early 2000s dotcom bust, the 2008 global financial crisis, and the pandemic in 2020.

The impact of rate cuts on the economy and market behavior is easily misunderstood. Lowering rates is intended to promote growth, but doing so during an economic crash means that a recession and bear market are likely to follow, or already underway. This means that rate cuts are historically correlated with poor market returns even though the rate cuts were in response to, rather than the cause of, these challenges.

Conversely, rate hikes are typically seen as slowing the economy, they often occur during economic booms and bull markets as the Fed slowly pumps the brakes. Thus, counterintuitively, rate hikes have historically corresponded to strong market returns.

Today, the Fed is not battling a sudden economic collapse or financial crisis but is navigating a period of slowing growth, decreasing inflation rates and a weakening but still strong labor market. In other words, the current situation is different from periods of emergency rate cuts. This is why the rationale for lowering rates matters when considering how they might impact markets in the months and years ahead.

Perhaps a more applicable example is the 1994-1996 rate cycle, when the Fed raised rates to combat inflation fears before lowering them again shortly thereafter. Periods like these are often referred to as “soft landings” since the Fed arguably managed to raise and lower rates without triggering a recession. There was initial shock to the bond prices – just as there was in 2022 – markets eventually responded positively to rate cuts once the economy stabilized.

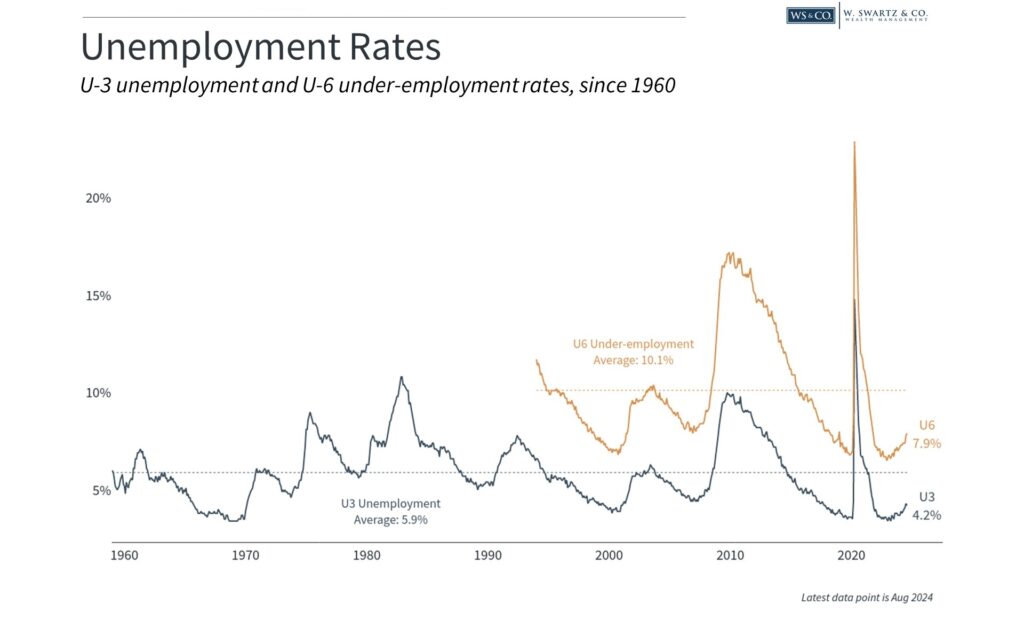

The Fed’s dual mandate, as described in the 1977 Federal Reserve Act, is “to promote maximum employment and stable prices.” Today, this is interpreted as returning the inflation rate to 2% while ensuring the economy continues to grow steadily.

From 2009 to early 2020, inflation rates were below 2%, allowing the Fed to keep interest rates exceptionally low and corresponding with a strong job market. In contrast, the inflation of the past few years has required the Fed to make tough choices between price stability and jobs.

Fortunately, inflation numbers have improved since its peak in 2022. This doesn’t mean that prices are going back to pre-2022 levels, only that the speed that prices are rising (the dollar is being devalued) is much slower. The latest Consumer Price Index report showed that rates continued their gradual slowing in August, with the headline index rising 2.5% year-over-year. However, the Fed is hesitant to declare victory since core CPI, which excludes food and energy prices to measure the underlying trend, experienced an uptick to 3.2%. This was primarily attributed to stickiness in housing prices.

Monetary policy works with “long and variable lags.” Which means, if the Fed waits for inflation to be all the way back down to 2%, it may have waited too long. The cost of doing so would be an over-tightening of the job market. Thus, the recent softening in the employment data provides further support for reducing rates.

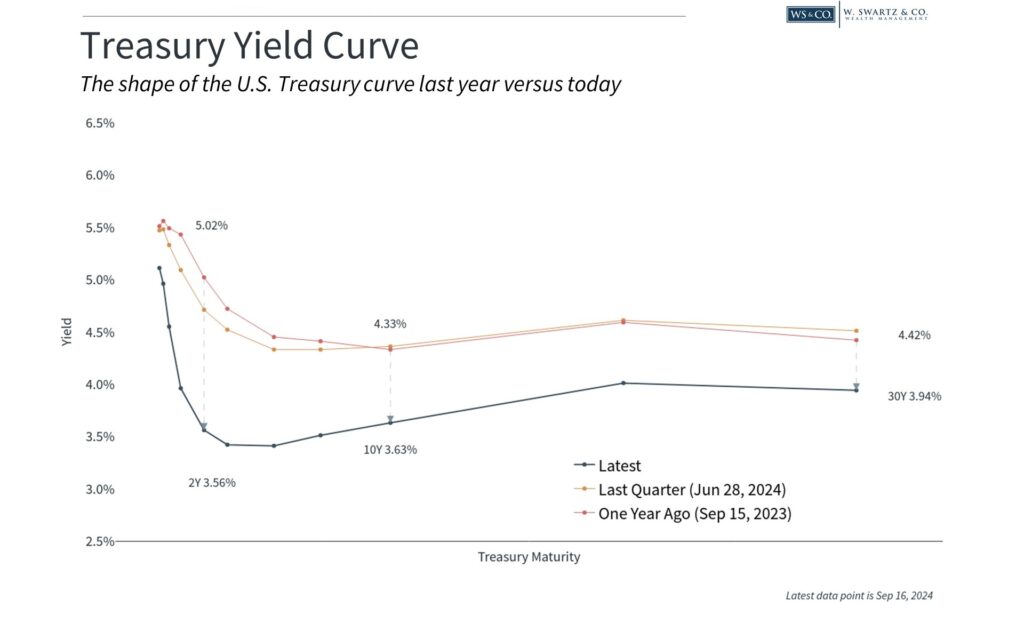

Given these economic trends, most economists and investors believe the Fed will cut rates a few times this year and throughout 2025. Bond yields have responded with the yield curve “dis-inverting” for the first time since the rate hike cycle began in 2022. This is because short-term interest rates, which are tied to Fed policy, have begun to fall while long-term interest rates, which are tied to economic growth, have not declined as much. This results in an “upward-sloping” yield curve which is often seen as positive for the economy.

Lower rates have been positive for both stocks and bonds across history. Bond prices move in the opposite direction of bond yields, which is why many bond indices have rebounded in recent weeks.

For stocks, lower interest rates mean that businesses have access to cheaper financing for investment and expansion. When it comes to the math of valuing companies, lower rates mean that future cash flows are discounted less, which can result in more attractive prices today. Of course, the market never moves up in a straight line, and investors should always be prepared for volatility.

The bottom line? Understanding why the Fed is cutting rates and the environment surrounding the moves is as important as the policy moves themselves. Currently the environment is slowing, but still positive economic growth, and falling inflation rates. If that remains true, it would be positive for capital markets.

Wyatt Swartz

Tuesday September 17th, 2024