September 1st, 2022, is looking like another red day for stocks. As I write this the global stock market is down -1.50% and the US stock market (S&P 500) is down -1.08%. The rally in markets following mid-June lows appears to be evaporating. Leading many, including me, to believe we have yet to hit bottom for this bear market.

Classic bear markets follow a pattern of low, but somewhat steady declines over the course of several months. Then a sharp pronounced cliff drop at the end, stocks hit bottom, and begin an new bull market expansion cycle.

However, sometimes we see “bear market rallies.” This occurs when stocks hit bear market levels (down -20%), rebound, and then fall again to lower lows than before. I find these prolonged bear markets to be more painful, even if the magnitude of the declines is less.

In the 2000 Bear Market stocks declined -23%, rebounded +11%, declined another -22%, rebounded +7%, and then fell another -30% before hitting bottom. The total magnitude of the drop was -45% from the prior peak. It was painful and unique not just because of the percentage decline, but because of the length of time it took to bottom. Stocks began their decline in March of 2000 and did not hit bottom until September 2002.

As I write, markets have been challenging to downright terrible for 14+ months. It is psychologically draining to investors (which might lead to a true bottom).

Looking at the market over the short-term, under ~14-months, it helps to think of it as a weighing machine for positive and negative forces.

Negative Market Forces:

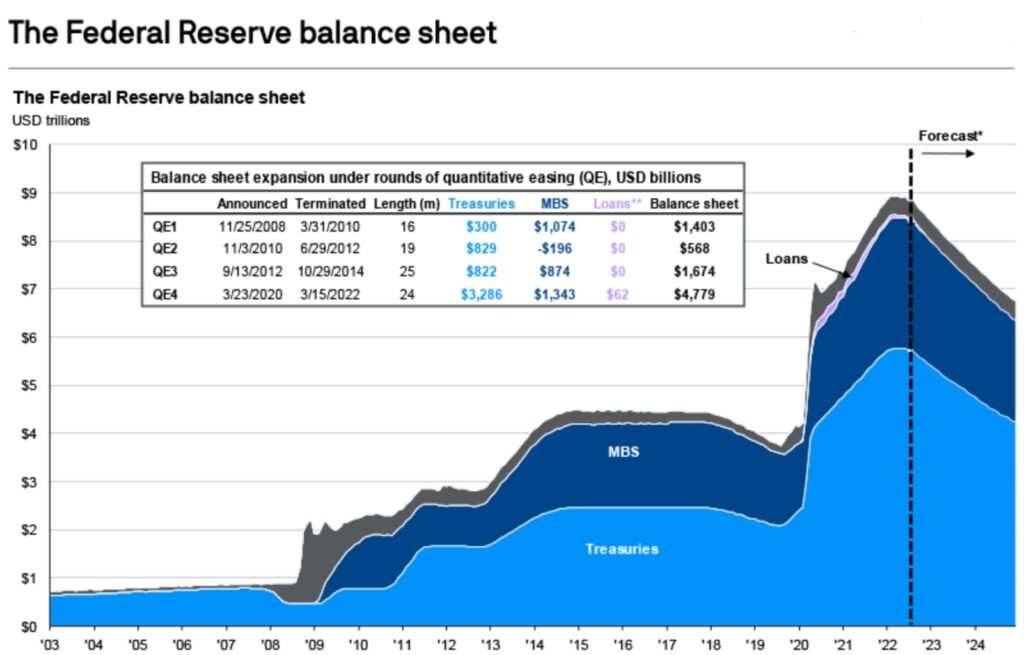

- Quantitative Tightening (QT) – Since 2008, the Federal Reserve (Fed) has been buying treasuries, and mortgage-backed securities. These purchases skewed the bond market and kept rates artificially low. As the Fed reduces and eventually stops purchases, the bond market will be free again. Rates should rise.

- Rising Rates – After spending over a year pretending there was no inflation, the Fed is trying to regain a shred of credibility by fighting inflation. Apart from QT, they are raising the Fed Funds Rate which effectively raises rates across the bond market.

- Recession & Earnings Revisions – The global recession is going to be a negative for markets until the data turns around. On top of macroeconomics, corporate earnings will probably be revised lower in 3Q.

- US Stock Valuations – Typically in bear markets, stocks bottom after they’ve reached cheap valuations. Starting the week US stocks were priced at 17x forward earnings. Lower earnings revisions will make stocks more expensive. My expecation is for stocks to hit 14x forward earnings (or lower) at bottom. That would mean prices have to come down, or earnings must go up. What do you think is more likely?

- Inflation – Over long-term periods inflation is a positive for stocks, becasue they are the only asset class that meaningfully provides significant ROI above the pace of inflation. In the short-term inflation is crippling for economies, and a negative force for markets.

Positive Market Forces:

- Stocks Go Up – At all times, broadly buying stocks is a sound investment long-term. The market is always long-term bullish. It is only a question of time. For that reason, investors should always have a bullish bias. Even today, as I’ve painted a dour picture for stocks in the short run, the probabilities of positive returns over the next 14+ months are very high.

Positioning investment portfolios requires knowledge of several factors that are unique to each individual investor.

That said, in my managed portfolios we favor value vs. growth stocks, we are tax-loss harvesting in taxable accounts, and using the green days in the market to reposition into a more defensive stance. We are holding a higher weighting to cash, and waiting for the inevitable bull market to come.

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com